Why Your Gift Could Trigger a Tax Trap — And How to Keep Returns Stable

You want to give something meaningful, not a surprise tax bill. I learned this the hard way when I transferred assets to a family member and nearly wrecked my investment stability. Gift tax pitfalls are silent wealth killers — they sneak up when you least expect them. In this article, I’ll walk you through real risks, how they impact your returns, and what actually works to stay safe — no jargon, just clarity. This is not about avoiding generosity. It’s about protecting it. With the right understanding, you can support loved ones without undermining your financial foundation or sacrificing long-term growth.

The Unseen Cost of Giving: What Gift Tax Really Means

At its core, the gift tax exists to prevent individuals from bypassing estate taxes by giving away large portions of their wealth before death. While the idea of taxing generosity may seem harsh, the system is designed to ensure fairness in how wealth is transferred across generations. The United States Internal Revenue Service (IRS) imposes a federal gift tax on transfers of money or property to others when nothing or less than full value is received in return. However, not every gift triggers a tax. Each year, a certain amount can be given per recipient without any reporting requirement — known as the annual exclusion. As of recent tax guidelines, this amount is adjusted periodically for inflation and allows individuals to gift up to a specific sum tax-free to as many people as they choose.

What most people don’t realize is that exceeding this annual limit doesn’t immediately mean writing a check to the IRS. Instead, the excess amount is counted against a much larger lifetime exemption — a cumulative total that shelters significant wealth from taxation. Once that lifetime exemption is used up, future taxable gifts could result in actual tax liability. This subtle mechanism means the danger isn’t always immediate, but it can accumulate quietly over time. A mother giving $20,000 to each of her three children annually may feel she’s being thoughtful and responsible, yet she’s using up her lifetime exemption at a steady pace, reducing the flexibility she’ll have later in life.

The real risk lies in misunderstanding how these rules interact with long-term financial goals. When large gifts are made without awareness of their cumulative effect, they can inadvertently limit options for estate planning, reduce available resources during retirement, or even force the sale of income-generating assets. For example, transferring appreciated stock to a child might seem like a smart way to pass on wealth, but it also transfers the original cost basis, meaning the recipient could face a larger capital gains tax when selling. These ripple effects often go unnoticed until a tax return reveals unexpected liabilities or investment performance suffers due to forced liquidations.

Moreover, the psychological comfort of believing a gift is “tax-free” can lead to overconfidence in financial decision-making. Many assume that because no tax is paid today, there’s no cost at all. But in reality, every taxable gift reduces the available exemption that could otherwise protect an estate from heavy taxation after death. This trade-off is rarely discussed in family conversations about inheritance or support. As a result, well-meaning actions today can compromise financial resilience tomorrow. Understanding the structure of the gift tax — not just its triggers but its long-term implications — is essential for anyone who values both generosity and stability.

When Generosity Backfires: Common Scenarios That Trigger Taxes

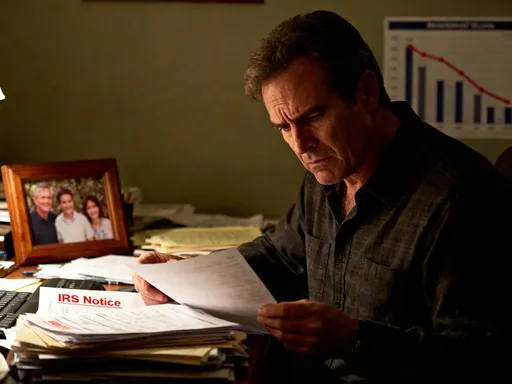

Consider a grandmother who wants to help her eldest grandson buy his first home. She transfers $100,000 directly into his bank account, believing she’s doing a noble thing — and she is. But what she doesn’t know is that this single act exceeds the annual exclusion for one recipient, requiring her to file a gift tax return. While she may not owe tax immediately due to her remaining lifetime exemption, the transaction is now on record, reducing the amount she can gift or bequeath tax-free in the future. If she repeats this kind of support for other grandchildren, the cumulative effect could exhaust her exemption years before she passes away, leaving her estate vulnerable to taxation.

Another common scenario involves small business owners who wish to gradually transfer ownership to their children. They may gift shares worth tens of thousands of dollars each year, intending to prepare the next generation for leadership. Yet without proper planning, these transfers can trigger complex tax reporting requirements and unintended consequences. For instance, if the business grows significantly in value after the gift, the child inherits the parent’s original cost basis. When the business is eventually sold, the capital gains tax could be substantial — a burden the recipient never anticipated. Worse, if the IRS determines that the valuation of the gifted shares was too low, it may reassess the gift’s value, potentially creating additional tax exposure.

Medical and educational expenses present another area where good intentions collide with tax rules. While direct payments for tuition or medical bills are exempt from gift tax, reimbursing someone after they’ve already paid can count as a taxable gift. A parent who repays their daughter’s student loan balance, for example, may believe they’re simply helping ease a burden. But unless the payment is made directly to the institution, it counts toward the annual exclusion and potentially the lifetime limit. Over time, such repayments can erode exemption space, especially if multiple family members receive similar support.

Even seemingly minor gifts can add up. Imagine an individual who gives $18,000 each year to five different nieces and nephews — a total of $90,000 annually. While each individual gift is just above the annual exclusion, the cumulative reporting requirement grows. Each year, a gift tax return must be filed to report the excess, and each dollar chips away at the lifetime exemption. This pattern may seem sustainable now, but if health issues arise or market conditions shift, the giver might later regret having reduced their financial cushion. These scenarios illustrate how emotional motivations often overshadow strategic thinking, leading to decisions that feel right in the moment but carry hidden costs down the road.

The Stability Myth: Why “Tax-Free” Gifts Aren’t Always Safe

There’s a widespread belief that as long as a gift falls under the annual exclusion or uses part of the lifetime exemption, it’s completely safe from tax consequences. This assumption creates a false sense of security. The truth is, even when no tax is due today, the decision to make a taxable gift has long-term implications for financial stability. Every dollar counted against the lifetime exemption is a dollar no longer available to shield an estate from taxation upon death. For many families, this trade-off is made without full awareness, eroding a critical layer of protection just when it may be needed most.

Take the case of a retired couple in their early seventies who decide to gift $1 million to their two children. They structure the transfer over several years to stay within annual limits where possible, but the bulk of the gift consumes their entire lifetime exemption. At the time, their estate is valued below the exemption threshold, so the move seems prudent. But five years later, a surge in real estate and market values causes their remaining assets to exceed the new exemption level. Because they’ve already used their full exemption, their estate now faces a substantial tax bill — one they thought they had avoided. Their generosity, while heartfelt, inadvertently exposed their heirs to financial strain.

This scenario underscores a crucial point: tax-free today does not mean consequence-free tomorrow. The exemption is a finite resource, and once it’s gone, it’s gone. There’s no replenishing it, and future changes in tax law could further reduce its value. Some lawmakers have proposed lowering the exemption amount in upcoming legislation, which would make early use of the current high limit even more costly in hindsight. Those who rush to gift large sums during periods of high exemption may find themselves regretting the decision if rules change and their estates become taxable again.

Additionally, premature gifting can disrupt investment strategies. To make large gifts, individuals may need to sell assets that were meant to generate long-term returns. Selling appreciated stock, real estate, or other holdings not only triggers capital gains taxes but also removes those assets from the portfolio, reducing future compounding potential. This forced reallocation can shift the balance of investments toward more conservative holdings, limiting growth and increasing vulnerability to inflation. The desire to be generous today can thus compromise the ability to maintain financial independence in later years, especially if longevity exceeds expectations or healthcare costs rise unexpectedly.

How Gift Tax Impacts Investment Strategy and Portfolio Growth

The connection between gifting and investment performance is often overlooked. When assets are transferred as gifts, the tax basis — the original purchase price — typically carries over to the recipient. This seemingly technical detail has profound implications for future returns. If a parent gives a child stock that was purchased decades ago at a low price, the child inherits both the asset and the low basis. When the stock is eventually sold, the capital gains tax will be calculated on the full appreciation — from the original purchase price to the sale price — potentially resulting in a much higher tax burden than if the asset had been inherited after death, when a step-up in basis usually applies.

This difference in tax treatment can significantly affect net returns. A gift made during life may appear generous on the surface, but it can transfer not only wealth but also future tax liability. In contrast, assets passed through an estate often receive a reset in cost basis, minimizing capital gains taxes for the heir. This makes the timing and method of transfer a critical factor in wealth preservation. For investors relying on long-term growth from equities, real estate, or private holdings, understanding this distinction is essential to avoid unintentionally diminishing the value of what they intend to pass on.

Furthermore, the act of gifting can necessitate changes in portfolio composition. To fund large gifts, individuals may need to liquidate positions that were performing well or were strategically positioned for diversification. Selling these assets not only incurs transaction costs and potential taxes but also disrupts the intended asset allocation. Rebalancing becomes more complex, and the portfolio may shift toward lower-growth instruments to compensate for reduced capital. Over time, this can slow the rate of wealth accumulation, making it harder to keep pace with inflation or meet long-term financial goals such as retirement income or legacy planning.

Tax reporting requirements also add administrative complexity. Any gift above the annual exclusion must be reported on IRS Form 709, even if no tax is owed. This creates a record that becomes part of the giver’s financial history and must be tracked carefully. Inaccurate reporting or missed filings can lead to penalties, audits, or disputes during estate settlement. For individuals managing their own finances, this added burden can be overwhelming, especially as they age and face increasing health or cognitive challenges. The need for meticulous documentation underscores the importance of integrating gifting into a broader financial plan rather than treating it as an isolated act of kindness.

Smart Moves That Protect Both Your Wealth and Your Intentions

Fortunately, there are effective ways to support loved ones without triggering unnecessary taxes or jeopardizing financial stability. One of the most powerful strategies is to pay for medical expenses or tuition directly to the provider or institution. These payments are exempt from gift tax and do not count toward the annual exclusion or lifetime exemption. A grandparent who pays a university directly for a grandchild’s tuition avoids any tax implications while still providing meaningful support. The same applies to medical bills paid directly to hospitals or clinics. This approach allows generosity to flow without eroding valuable exemption space.

Another smart option is the use of irrevocable trusts. By placing assets in a properly structured trust, individuals can provide for beneficiaries while maintaining some level of control and protection. Certain types of trusts, such as a **grantor retained annuity trust (GRAT)** or an **irrevocable life insurance trust (ILIT)**, allow for tax-efficient transfers and can help preserve the lifetime exemption. For example, a GRAT enables the grantor to transfer appreciating assets into the trust while retaining an income stream for a set period. If structured correctly, the remaining assets pass to beneficiaries with little or no gift tax consequence. These tools require careful setup and professional guidance, but they offer a way to balance generosity with long-term planning.

Timing also plays a crucial role. Spreading gifts over multiple years can help stay within annual exclusion limits and avoid using up the lifetime exemption too quickly. This approach, known as **gift splitting**, allows married couples to combine their individual exclusions, effectively doubling the amount they can give tax-free to each recipient. For instance, a couple can gift $36,000 per year to a child instead of $18,000, significantly increasing the impact without triggering reporting requirements. This method provides flexibility and preserves exemption space for future needs, such as long-term care or unexpected family emergencies.

Additionally, funding 529 college savings plans offers another tax-advantaged path. Contributions to these accounts grow tax-free when used for qualified education expenses, and the account owner retains control over the funds. Some states even offer income tax deductions for contributions. A single large contribution can be treated as if it were spread over five years for gift tax purposes, allowing up to five times the annual exclusion amount to be gifted without using any of the lifetime exemption. This “front-loading” strategy maximizes both educational support and tax efficiency, making it a popular choice among grandparents and parents alike.

Timing, Tracking, and Talking: The Three Keys to Safer Gifting

Successful gifting isn’t just about the amount given — it’s about how, when, and why it’s done. The first key is timing. Making gifts when asset values are lower, such as during a market downturn, can reduce the taxable value of the transfer. This strategy, known as **discounted gifting**, allows more shares or units to be transferred for the same dollar value, maximizing the benefit to the recipient while minimizing the impact on the giver’s exemption. Similarly, gifting before a business valuation increases — such as prior to an acquisition or IPO — can lock in lower values and reduce future tax exposure.

The second key is tracking. Every gift above the annual exclusion must be documented and reported. Keeping detailed records — including dates, amounts, asset descriptions, and recipient information — ensures compliance and prevents errors. Many individuals fail to realize that gifts to the same person over multiple years are cumulative and must be tracked over time. Without a system in place, it’s easy to exceed limits unintentionally. Using financial software, spreadsheets, or working with an advisor can help maintain accurate records and provide peace of mind.

The third and perhaps most important key is talking. Open conversations with family members and financial professionals can prevent misunderstandings and align expectations. A parent who plans to gift assets should discuss the decision with adult children, explaining both the intent and the limitations. Similarly, consulting with a tax advisor or estate planner ensures that gifting fits within a broader financial strategy. These discussions don’t have to be formal, but they should be honest and informed. When everyone understands the rules, the risks, and the goals, generosity can flourish without fear of unintended consequences.

Building a Legacy Without Breaking the Bank: Long-Term Stability Through Smarter Giving

True wealth is not measured solely by numbers in an account, but by the impact it has on the people who matter most. The desire to help family members — whether through education, homeownership, or financial security — is a natural and noble instinct. But without careful planning, even the most well-intentioned gifts can undermine the very stability they aim to create. The gift tax system, while complex, is not designed to punish generosity. It is a framework that encourages thoughtful, sustainable wealth transfer. By understanding its rules and working within them, individuals can protect both their financial legacy and their emotional intentions.

The most enduring gifts are not always the largest, but the most wisely given. Preserving investment stability does not require withholding support — it requires aligning generosity with strategy. Whether through direct payments for essential expenses, the use of trusts, or careful timing and documentation, there are proven ways to give meaningfully without sacrificing long-term security. These methods allow families to thrive across generations, ensuring that support today does not come at the cost of resilience tomorrow.

In the end, financial wisdom and heartfelt generosity are not opposites — they are partners. A gift that strengthens a child’s future without weakening a parent’s retirement is not a compromise; it is a triumph. By taking the time to understand the rules, seek professional advice, and plan with clarity, anyone can become a steward of lasting wealth. The goal is not to avoid giving, but to give in a way that honors both love and responsibility. That kind of legacy doesn’t just survive — it grows.