How I Turned Spare Change Into Lasting Wealth — A Real Side Hustler’s Playbook

What if the side income you earn from freelance gigs, weekend projects, or online sales could do more than just cover bills? I used to think extra cash was just for spending—until I realized it could grow into real wealth. This isn’t about get-rich-quick schemes or risky bets. It’s about turning small, consistent earnings into appreciating assets. In this guide, I’ll walk you through how I shifted my mindset, avoided common traps, and built long-term value from my side hustle income—step by step, decision by decision. The journey began not with a windfall, but with awareness: every dollar earned outside my main job didn’t have to vanish into daily expenses. It could be the beginning of something lasting. This is the playbook that helped me make that shift—and it can work for you too.

The Side Income Mindshift: From Spending to Growing

Most people treat side income like found money—a bonus to be spent freely. A few extra hundred dollars from a weekend consulting job? That’s dinner out, a new gadget, or a spontaneous shopping trip. But this mindset, while emotionally satisfying in the short term, sabotages long-term financial health. When side earnings are funneled straight into consumption, they provide momentary pleasure but zero lasting value. The real power of side income lies not in how much you earn, but in how you use it. The first and most crucial step toward building wealth is changing your perception: side hustle money is not spending money—it is seed capital.

This shift in thinking doesn’t happen overnight. It requires intentionality and a clear understanding of financial priorities. For years, I viewed my freelance design work as a way to supplement my household budget. Extra income covered groceries, school supplies, or seasonal gifts. There was comfort in that—knowing we could handle unexpected costs. But after tracking my side earnings over six months, I realized something startling: I had made nearly $3,000, yet had nothing to show for it. No savings, no investments, no growth. All of it had been absorbed into our regular spending. That was the wake-up call. I began to ask myself: what if I had invested just half of that amount? What if I treated every side dollar as a building block rather than a disposable resource?

The psychological barrier to this shift is real. Humans are wired to seek immediate rewards. Delayed gratification feels unnatural, especially when money is tight. But side income offers a unique opportunity because it’s not needed for survival. Unlike your primary paycheck, which must cover rent, utilities, and food, side earnings come with built-in flexibility. That flexibility is a gift—it allows you to choose growth over consumption. By redirecting even a portion of these funds toward asset-building, you begin to leverage compounding, diversification, and time—the most powerful forces in personal finance. The key is to decide in advance how side income will be used. Automating transfers to investment accounts, setting up separate savings buckets, or allocating a fixed percentage to learning new skills can institutionalize this new mindset. Over time, the habit replaces impulse, and discipline becomes second nature.

What Counts as an Asset? Defining Value That Grows

Not all purchases are equal. A new laptop for work may be necessary, but it loses value the moment you buy it. A vacation creates memories, but it doesn’t generate future returns. To build lasting wealth, you must distinguish between assets and liabilities. An asset is anything that has the potential to increase in value or generate income over time. A liability is something that drains money through depreciation or ongoing costs. The goal is to turn side income into true assets—resources that work for you, not against you.

Common financial assets include index funds, dividend-paying stocks, real estate, and retirement accounts. These instruments have a long history of appreciation when held over time. For example, the S&P 500 has delivered an average annual return of about 10% over the past century, even with market fluctuations. By investing in broad-market index funds, you gain exposure to hundreds of companies with low fees and minimal effort. Dividend stocks add another layer: they pay you regularly just for owning them, creating a stream of passive income that can be reinvested. Real estate, while requiring more capital and management, offers both rental income and long-term value growth, especially in stable markets.

Beyond traditional investments, modern side earners have access to digital assets and income-generating platforms. Creating an online course, building a niche website, or developing a mobile app can turn skills into scalable assets. Once built, these can generate revenue with little ongoing effort. Similarly, investing in high-yield savings accounts or certificates of deposit may not offer explosive growth, but they provide safety and predictable returns—ideal for risk-averse individuals or short-term goals. The key is alignment: your asset choices should match your risk tolerance, time horizon, and financial objectives. A 35-year-old with a stable job might allocate more to stocks, while a parent nearing retirement may prefer the stability of bonds or real estate.

Skill-building is another often-overlooked form of asset. Paying for a certification in project management, digital marketing, or financial planning isn’t an expense—it’s an investment in human capital. These skills increase your earning potential, making future side gigs more lucrative. Unlike physical goods, knowledge appreciates with use. The more you apply a skill, the more valuable it becomes. This dual benefit—immediate utility and long-term growth—makes education one of the most reliable assets available. The takeaway is clear: real wealth comes from owning things that grow or produce, not things that decay or drain.

Start Small, Think Big: Building Assets Without Big Capital

One of the biggest misconceptions about investing is that you need large sums of money to get started. This belief keeps many side hustlers from taking action. But the truth is, wealth is rarely built in one big leap—it’s accumulated through small, consistent actions over time. Even $50 a month, invested wisely, can grow into a meaningful sum thanks to the power of compounding. The key is not the amount you start with, but the habit of investing regularly.

Dollar-cost averaging is one of the most effective strategies for small investors. Instead of trying to time the market—a game even professionals lose—you invest a fixed amount at regular intervals, such as monthly. When prices are high, you buy fewer shares; when prices are low, you buy more. Over time, this smooths out volatility and reduces risk. Many brokerage platforms now offer micro-investing apps that automate this process, allowing users to invest spare change from everyday purchases. These tools make it easy to begin without feeling overwhelmed.

Consider this example: if you earn an average of $400 per month from a side gig and invest just half—$200—into a low-cost index fund with a 7% annual return, after 20 years you would have over $100,000. Extend that to 30 years, and the total exceeds $240,000. These numbers are not hypothetical—they are based on real historical returns and compound interest calculations. The magic lies in consistency. Missing a few months won’t ruin the plan, but stopping altogether will. That’s why automation is so powerful: setting up automatic transfers removes the need for constant decision-making. The money moves before you have a chance to spend it.

Another advantage of starting small is that it allows you to learn without high stakes. As you gain experience, you can adjust your strategy—increasing contributions, diversifying holdings, or exploring new opportunities. The goal isn’t to maximize returns immediately, but to build confidence and discipline. Over time, as your side income grows, so can your investments. What begins as a modest habit evolves into a robust financial foundation. The message is simple: you don’t need to be rich to start building wealth. You just need to start.

Risk Control: Protecting Your Gains While Growing Them

Investing always involves risk, but smart risk management turns uncertainty into opportunity. The goal is not to avoid risk entirely—that’s impossible—but to understand it, measure it, and mitigate it. For side earners, protecting what you’ve earned is just as important as growing it. Without safeguards, a single poor decision or market downturn can erase years of progress. That’s why risk control must be a core part of any wealth-building strategy.

Diversification is the most proven method of reducing risk. Instead of putting all your side income into one stock or venture, spread it across different asset classes. A balanced portfolio might include a mix of stocks, bonds, real estate, and cash equivalents. This way, if one sector underperforms, others can help offset the loss. For example, during economic downturns, bonds often hold value while stocks decline. Over the long term, diversified portfolios tend to deliver more stable returns with less volatility. Exchange-traded funds (ETFs) and mutual funds make diversification accessible, offering exposure to hundreds of assets in a single purchase.

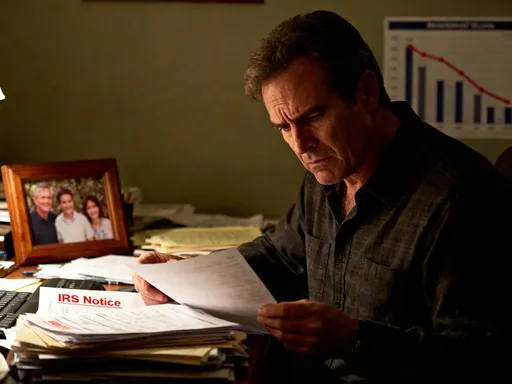

Another essential safeguard is the emergency fund. Before investing heavily, ensure you have three to six months’ worth of living expenses saved in a liquid, low-risk account. This cushion prevents you from selling investments at a loss during unexpected crises—like a medical issue or job disruption. Without it, even well-planned strategies can unravel. The emergency fund acts as a financial shock absorber, allowing you to stay invested for the long term without panic.

Emotional discipline is equally important. Market fluctuations are normal, but fear and greed can lead to poor decisions. Selling during a downturn locks in losses, while chasing hot trends often leads to buying high and selling low. To avoid this, define your investment plan in advance and stick to it. Set clear goals, time horizons, and risk limits. If you’re unsure, consulting a fee-only financial advisor can provide objective guidance without conflicts of interest. Remember, investing is not about beating the market—it’s about staying the course.

The Reinvestment Loop: Letting Your Assets Work for You

Compounding is often called the eighth wonder of the world—and for good reason. It’s the process by which earnings generate more earnings over time. When you reinvest dividends, interest, or profits, they begin to earn their own returns. This creates a self-reinforcing cycle: growth accelerates not because you add more money, but because your existing assets are working harder. The reinvestment loop is the engine of long-term wealth.

Consider a dividend-paying stock that returns 3% annually. If you take the dividends as cash, you receive a steady income. But if you reinvest them, you buy more shares, which then generate their own dividends. Over time, this snowball effect dramatically increases both your share count and total returns. Historically, reinvested dividends have accounted for a significant portion of total stock market gains. For long-term investors, skipping reinvestment means leaving substantial growth on the table.

The same principle applies to side businesses. Suppose you earn $1,000 from a freelance project. Spending it brings immediate benefit, but reinvesting part of it—say, $300—into better equipment, marketing, or training—can increase your future earnings. That upgrade might allow you to charge higher rates, attract better clients, or work more efficiently. The next project could earn $1,300, then $1,600, and so on. Each reinvestment amplifies your capacity to earn, creating a virtuous cycle.

Automation makes this loop sustainable. Most brokerage accounts allow you to enable automatic dividend reinvestment at no cost. Similarly, you can set up rules to transfer a percentage of each side income payment directly into investment or savings accounts. These systems operate in the background, requiring no daily effort. The result? Your money grows not because you’re constantly managing it, but because you set the right conditions early. Over decades, this passive compounding transforms modest contributions into substantial wealth. The lesson is clear: let your money work for you, and over time, it will do the heavy lifting.

Skills as Assets: Investing in Yourself for Higher Returns

While financial assets are important, the most valuable asset you own is yourself. Your skills, knowledge, and ability to earn income are the foundation of all wealth. Unlike stocks or real estate, your human capital can appreciate indefinitely with effort and learning. Allocating part of your side income toward personal development is one of the highest-return investments you can make.

Imagine spending $500 on a certification in data analysis or digital marketing. That may seem like a large expense at first, but if it enables you to charge 30% more per project, the return is immediate and ongoing. A freelancer earning $50 per hour who increases their rate to $65 gains an extra $15 on every hour worked. Over 100 hours, that’s $1,500—more than triple the initial investment. And unlike physical assets, this skill can’t be lost or stolen. It travels with you, opens doors, and compounds with experience.

Not all learning requires spending money. Many high-quality resources are free or low-cost. Online platforms offer courses in finance, coding, writing, and design, often taught by industry experts. Libraries, community colleges, and professional associations also provide affordable training. The key is to focus on skills with strong market demand. Financial literacy, for example, pays dividends in every area of life—helping you budget better, invest wisely, and avoid costly mistakes. Time spent learning compound interest, tax strategies, or retirement planning has lasting value.

To maximize return on self-investment, set clear goals and track progress. Ask: how will this skill increase my income or reduce expenses? Can I measure the impact through higher rates, more clients, or greater efficiency? Regularly reviewing your development ensures you’re investing in what truly matters. Over time, this focus on growth transforms your side hustle from a temporary gig into a scalable career. You’re not just earning more—you’re becoming more capable, confident, and financially secure.

Staying Consistent: Habits That Turn Side Hustles Into Wealth Engines

Knowledge alone doesn’t build wealth—habits do. The most effective financial strategies fail without consistency. Life gets busy, emergencies arise, and motivation fades. That’s why sustainable habits are the backbone of long-term success. They keep you on track even when willpower runs low. The good news is that consistency can be designed, not endured.

Start with clear, measurable goals. Instead of saying, “I want to be rich,” define what that means: “I want to have $50,000 in investments within ten years.” Break it down further: that’s about $250 per month at a 6% return. Now the goal is actionable. Track your progress quarterly, but avoid obsessing over daily market swings. Focus on inputs—how much you save and invest—rather than outputs, which depend on factors beyond your control.

Next, automate as much as possible. Set up direct deposits from side income into designated accounts. Use apps that round up purchases and invest the difference. Automating removes decision fatigue and ensures follow-through. It’s easier to stick to a plan when you don’t have to think about it every month.

Finally, build in flexibility and self-compassion. If you miss a month, don’t quit. Wealth is built over decades, not days. Small setbacks are normal. What matters is returning to the plan. Celebrate milestones—a year of consistent investing, reaching $10,000 in assets—but stay focused on the long game. Avoid comparing yourself to others; everyone’s journey is different. With patience and discipline, your side hustle can evolve from a source of extra cash into a true wealth engine.

From Extra Cash to Lasting Value

The transformation from spending side income to building lasting wealth doesn’t require genius or luck. It requires a shift in mindset, a commitment to learning, and the discipline to act consistently. Every dollar earned from a side hustle is a choice—an opportunity to either consume or create. When you choose creation, you begin to harness the forces of compounding, diversification, and personal growth. Over time, small decisions accumulate into significant results.

Real wealth is not about flashy cars or luxury vacations. It’s about security, freedom, and peace of mind. It’s knowing you have resources that grow even when you’re not actively working. This kind of financial resilience is within reach for anyone willing to redirect their earnings with purpose. You don’t need a six-figure salary or a lucky break. You just need to start where you are, use what you have, and do what you can.

By treating side income as seed capital, investing in appreciating assets, managing risk wisely, and continuously improving your skills, you lay the foundation for long-term prosperity. The journey is gradual, but the direction matters more than the speed. Every contribution, no matter how small, moves you closer to financial independence. The habits you build today will shape your tomorrow. And in the end, it’s not about getting rich quickly—it’s about building something real, one thoughtful decision at a time.