How I Stopped Panic Spending in Emergencies — And Took Control of My Cash

Ever had an unexpected bill hit you out of nowhere? I did — and it wrecked my budget. After falling into the emergency spending trap twice, I realized I wasn’t managing money; I was just reacting. What changed? A few practical, no-BS strategies focused on cost control and冷静 decision-making. No jargon, no magic formulas — just real steps that helped me stay calm, cut costs, and protect my finances when it mattered most. Let me walk you through what actually works.

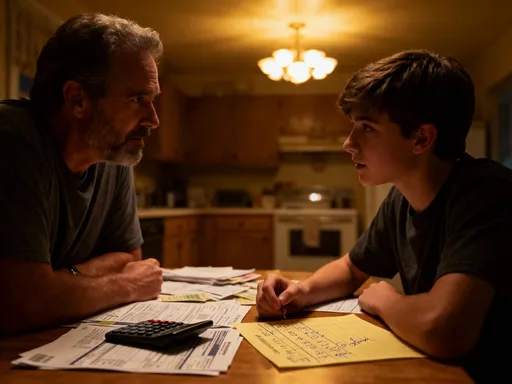

The Moment Everything Changed: Facing My First Real Financial Emergency

It started with a noise — a low, grinding sound coming from under my car as I pulled into the grocery store parking lot. At first, I ignored it. But by the time I got home, the car wouldn’t start. The mechanic’s call came the next morning: $1,200 for repairs. I didn’t have that kind of money sitting in my checking account. My emergency fund? It existed in theory, but in practice, it had been drained months earlier by a dental bill and a home water leak. I was on my own.

What followed wasn’t just a repair. It was a spiral. I charged the cost on a high-interest credit card, telling myself I’d pay it off quickly. But then the interest began to accrue, and a few weeks later, another surprise hit — a medical co-pay for my daughter’s asthma treatment. Suddenly, I was juggling multiple payments, stressed at work, and avoiding my bank app. I wasn’t managing my money anymore; I was being managed by it. The worst part wasn’t the debt — it was the feeling of helplessness, the sense that no matter how careful I was, one bad day could undo months of effort.

This experience exposed a critical gap in my financial planning: I had a budget, but no crisis protocol. I could track groceries and plan for vacations, but when real pressure hit, I fell apart. Traditional budgeting teaches us how to allocate income, but it rarely prepares us for the emotional and logistical chaos of an emergency. I had savings goals, but no rules for when to spend — and how much. I learned the hard way that having money isn’t the same as being in control of it. True financial resilience isn’t just about how much you save. It’s about how you behave when the unexpected happens.

Why Emergencies Make Us Spend More — And How to Break the Cycle

When a crisis hits, our brains don’t switch into logical mode — they go into survival mode. The sudden need for cash triggers a cascade of psychological responses: urgency, fear of loss, and decision fatigue. These aren’t flaws; they’re human instincts. But in the context of modern finance, they can be costly. Behavioral economists call this present bias — the tendency to prioritize immediate relief over long-term stability. When your car won’t start or your water heater bursts, the thought of paying more to fix it fast feels minor compared to the stress of not having a solution. But those small, rushed decisions compound quickly.

Consider a common scenario: a broken refrigerator. If you need a replacement immediately, you might walk into a big-box store and buy the first model available, especially if they offer same-day delivery. But that convenience comes at a price. You’re likely to pay 20% to 30% more than if you’d shopped online or waited for a sale. You might also skip extended warranties or energy efficiency comparisons — details that matter over time. What feels like a single emergency expense becomes a long-term financial burden. The real cost isn’t just the sticker price; it’s the lack of time to negotiate, compare, or consider alternatives.

Another powerful force at play is loss aversion — the idea that we feel the pain of losing money more intensely than the pleasure of gaining it. In an emergency, this can backfire. We’ll spend more to avoid the feeling of loss — whether it’s losing time, comfort, or control. For example, hiring the first plumber who answers the phone, even if their rate is high, feels safer than waiting for a better option. But this fear-driven spending often leads to overpaying. The key to breaking this cycle isn’t willpower; it’s structure. When emotions run high, clear rules and pre-planned responses can override impulsive choices. Awareness of these mental traps is the first step. The next is building systems that protect you when your judgment is compromised.

Building Your Emergency Shield: Practical Cost-Control Frameworks

After my second financial emergency — a surprise roof repair that nearly doubled my monthly expenses — I knew I needed more than just a bigger savings account. I needed a framework for spending, not just saving. What I created wasn’t complicated, but it was intentional. I call it my Emergency Shield: a flexible system designed to prevent panic spending while still allowing for necessary action. It rests on three pillars: spending triggers, approval rules, and buffer zones.

Spending triggers are clear thresholds that define what counts as a true emergency. For me, it’s anything that threatens safety, health, or basic income — a broken heater in winter, a car needed for work, or urgent medical care. These are non-negotiable. Everything else — a cracked phone screen, a leaking faucet, or a last-minute event — goes into a separate category. By clearly defining what qualifies, I avoid blurring the lines when stress clouds my judgment.

Approval rules are my personal checklist before spending over a certain amount. For any emergency expense above $300, I require at least two quotes, a 24-hour waiting period, and a check against my emergency fund balance. This simple process forces me to pause, gather information, and avoid snap decisions. It also builds discipline over time. Even if I end up choosing the first option, the act of comparison reduces regret and often leads to better deals.

Buffer zones are pre-allocated spending limits within my emergency fund. Instead of treating the fund as one lump sum, I divide it into tiers: $500 for minor issues, $1,500 for moderate ones, and $3,000 for major crises. This helps me gauge the scale of the problem and respond proportionally. It also prevents me from draining the entire fund on a single event. These zones are not rigid — they adjust with my income and life changes — but they provide structure when I need it most. I also shared these rules with my family, so everyone understands the limits and can support the process. Financial control isn’t a solo act; it’s a team effort.

The Hidden Leaks: Where Emergency Money Really Disappears

Most of us focus on the big ticket — the $1,000 repair, the $800 medical bill. But the real erosion of emergency funds often comes from smaller, overlooked costs that pile up in the background. These are the hidden leaks: convenience fees, rushed shipping charges, emergency service premiums, and impulse replacements. Alone, each might seem minor. Together, they can add hundreds — even thousands — to the total cost of a crisis.

Take the example of replacing a broken washing machine. If you need it immediately, you might pay extra for same-day delivery or installation. You might also buy a model that’s in stock, rather than the most efficient or durable one. And if you’re stressed, you might overlook simple repairs that could extend the life of the old machine. In one real case, a woman I spoke with spent $1,100 on a new washer because she didn’t know a $120 part could have fixed the old one. She also paid $99 for delivery and another $75 for haul-away — costs she could have avoided with more time and research.

Another common leak is the use of high-cost financing in a pinch. Payday loans, retail credit cards with deferred interest, or even “buy now, pay later” plans can seem like lifelines. But if not managed carefully, they become traps. A $600 appliance financed over six months with deferred interest sounds manageable — until you miss a payment and get hit with retroactive fees. These products are designed for urgency, not long-term value.

So how do you plug these leaks? Start by building a list of trusted, low-cost alternatives. Know which local repair shops offer free diagnostics, which stores price-match, and which community programs provide temporary assistance. Consider peer lending through family or friends with clear repayment terms — often cheaper and more flexible than formal loans. Delay non-critical purchases by 48 hours to allow for cooling-off and research. And always ask: “Is this urgent, or just uncomfortable?” The difference matters. Small, deliberate choices — like choosing standard shipping over express, or repairing instead of replacing — can save hundreds per incident. Over time, those savings become a form of invisible income.

Smarter, Not Tighter: Balancing Cost Control With Dignity and Needs

There’s a myth in personal finance that resilience means enduring hardship — that true financial strength is measured by how little you spend, even in crisis. But extreme frugality during emergencies can do more harm than good. Cutting too deep can damage your health, strain relationships, and delay recovery. The goal isn’t to suffer; it’s to stay in control without losing your sense of dignity or well-being.

I learned this the hard way when I tried to fix a plumbing issue myself to save money. I watched a few videos, bought some tools, and ended up making the leak worse. The repair cost doubled, and I spent days cleaning up water damage. My attempt to save turned into a bigger expense — and a lot of stress. I had confused frugality with competence. Not every cost can or should be cut. Some services are worth paying for because they save time, reduce risk, and preserve peace of mind.

The smarter approach is to prioritize needs over wants, but also to recognize that comfort and mental health are legitimate needs. If you’re stressed and exhausted, your decision-making suffers. That’s why I now build small comfort buffers into my emergency plan. For example, if I’m dealing with a major repair, I allow myself one takeout meal per week — not as a luxury, but as a way to conserve energy for bigger decisions. I also keep a small “stress fund” — $50 to $100 set aside specifically for small pleasures during tough times, like a coffee, a movie rental, or a short walk in a paid park. These aren’t indulgences; they’re maintenance for my mental engine.

Self-compassion is part of financial health. Beating yourself up for past mistakes or setting unrealistic expectations only fuels anxiety. Instead, focus on progress, not perfection. Ask: “What’s the most responsible choice I can make right now?” not “What’s the cheapest possible option?” This shift in mindset — from deprivation to empowerment — makes cost control sustainable. You’re not denying yourself; you’re protecting your future. And that makes all the difference.

Tools That Actually Help — Not Just Trackers and Apps

Budgeting apps are useful, but during a crisis, they often fall short. When stress is high, what you need isn’t more data — it’s fewer decisions. That’s why I’ve moved beyond digital tracking to simpler, more tactile tools that reduce mental load and keep me grounded. These aren’t flashy, but they work when it counts.

One of my most effective tools is the cash envelope system — adapted for emergencies. I keep a small, labeled envelope in my desk drawer with $200 in cash designated for minor urgent expenses. If I need to pay a handyman on the spot or cover a small repair, I use this first. Once the cash is gone, I stop spending until I can reassess. The physical limit creates a hard boundary that a digital balance doesn’t. Seeing the money disappear makes the cost real in a way that a screen never can.

Another powerful tool is the decision journal. I keep a small notebook where I record every emergency expense: what it was, why it was necessary, how much I paid, and what I learned. Over time, this becomes a personal database of lessons. When a similar issue comes up, I can look back and see what worked before. Did I get a good deal? Could I have waited? Was there a cheaper alternative? This reflection turns past mistakes into future wisdom. It also reduces repetition — I’m less likely to make the same error twice when I’ve written it down.

I also maintain a pre-written list of trusted vendors: plumbers, electricians, mechanics, and repair services I’ve used and vetted. This list saves time and reduces anxiety when a crisis hits. No more frantic Google searches or relying on the first ad that pops up. I know who to call, what their typical rates are, and what to expect. This preparation alone has saved me hours and hundreds of dollars. These tools — simple, physical, and repeatable — don’t promise quick fixes. But they build consistency, clarity, and confidence when it matters most.

From Reaction to Readiness: Creating Your Own Emergency Playbook

The final step in taking control is creating your own Emergency Playbook — a personalized, written plan for handling financial shocks. This isn’t a generic budget or a list of tips. It’s a living document that reflects your life, values, and past experiences. Mine started as a few notes after my car repair, but it’s grown into a comprehensive guide I review every six months.

Start by listing the most likely emergencies you could face: car repairs, medical bills, home maintenance, job loss, or family care costs. For each, define your response: what you’ll do, who you’ll call, how much you’ll spend, and what rules apply. Include your spending triggers, approval process, and buffer zones. Write down your vendor list, your emergency contacts, and your access points for funds. Keep it simple, clear, and easy to find — I keep a printed copy in my filing cabinet and a digital one in my password manager.

Then, test it. Run a “financial fire drill” once a year. Pick a hypothetical emergency — say, a broken furnace — and walk through your plan step by step. Do you know who to call? Can you access your emergency fund quickly? Are your approval rules clear? This practice builds muscle memory so that when real stress hits, you’re not starting from scratch. You’re following a path you’ve already walked.

Finally, integrate your lessons. Every time you face a real emergency, add a note to your playbook. What went well? What would you change? This turns every crisis into a teacher. Over time, you’ll notice patterns — recurring costs, trusted providers, effective strategies — that help you refine your approach. The goal isn’t to eliminate emergencies; they’re part of life. The goal is to transform your relationship with them — from fear to readiness, from reaction to control. When you stop dreading the next surprise and start preparing for it, you gain something more valuable than money: peace of mind. And that, more than any balance sheet, is the true measure of financial strength.