How I Fixed My Portfolio: A Real Fix for Smarter Returns

Remember that sinking feeling when your investments just… stall? I’ve been there—watching markets move while my returns lagged, despite “diversifying.” It wasn’t until I rethought how I manage funds that things shifted. This isn’t about chasing hot stocks or timing the market. It’s about a smarter way to allocate assets—one that balances growth and safety. Let me walk you through what actually worked. For years, I believed I was doing everything right: spreading money across mutual funds, checking balances occasionally, and assuming long-term growth was inevitable. But when the market climbed and my portfolio barely budged, I realized something was wrong. The truth? Many of us think we’re investing wisely, but we’re actually operating on outdated assumptions. What follows is not a get-rich-quick scheme, but a real-world approach to building a more resilient, efficient, and purpose-driven investment strategy—one that focuses on structure, not speculation.

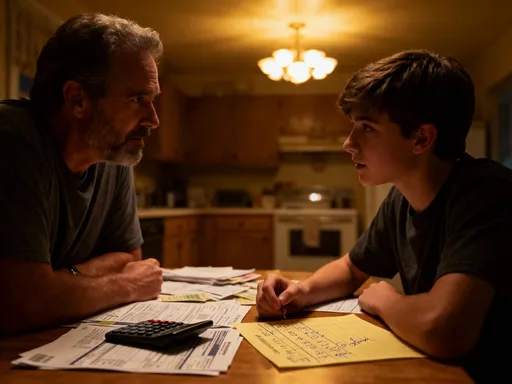

The Wake-Up Call: When My Portfolio Stopped Working

For over a decade, I followed what I thought was a sound investment strategy: I contributed regularly to my 401(k), diversified across a handful of mutual funds, and left the rest to time. I believed that simply owning different types of funds—large-cap, small-cap, international, and bonds—meant I was protected. I even felt a sense of pride in not checking my account too often, convinced that patience was the hallmark of a disciplined investor. But when I finally sat down to review my annual performance in detail, the numbers told a different story. While the S&P 500 returned nearly 14% over the previous year, my overall portfolio had gained only 4.2%. That gap wasn’t just disappointing—it was alarming.

What made this worse was that I wasn’t alone. A growing number of long-term investors have experienced similar stagnation, not because they were lazy or uninformed, but because they relied on a flawed understanding of diversification. I had assumed that owning multiple funds automatically reduced risk, but I hadn’t considered how those funds actually behaved when markets shifted. During the volatility of the previous year, nearly all my holdings dropped in tandem. When interest rates rose, both my bond funds and growth-oriented equities suffered. When inflation spiked, my international fund struggled alongside my domestic ones. The so-called diversification I’d trusted offered little real protection.

This disconnect forced me to ask hard questions. Was my underperformance due to bad timing? High fees? Or was the problem deeper—rooted in how I had structured my asset allocation from the start? I began to suspect it was the last one. I realized that true risk management isn’t about how many funds you own, but how those funds interact with each other under different economic conditions. My wake-up call wasn’t a single event, but a slow realization: I had confused variety with resilience. That moment of clarity became the starting point for rebuilding my portfolio—not with more complexity, but with greater intention.

Understanding Asset Allocation Beyond the Basics

Most financial advice simplifies asset allocation to a basic split: stocks for growth, bonds for stability. A common rule of thumb suggests subtracting your age from 100 to determine your stock allocation. While these guidelines offer a starting point, they fall short for investors seeking real risk control and consistent returns. I learned that effective asset allocation goes far beyond a simple percentage split. It’s a strategic framework that aligns investments with specific financial goals, time horizons, and personal tolerance for market swings. More importantly, it considers how different assets respond to economic forces like inflation, interest rates, and global growth.

For example, not all stock investments behave the same way. Growth stocks often thrive in low-interest-rate environments but can plummet when rates rise. Value stocks, on the other hand, tend to hold up better during periods of economic uncertainty. Similarly, different types of bonds—such as Treasury bonds, municipal bonds, and corporate bonds—react differently to market changes. International bonds may offer diversification benefits when U.S. rates shift, but they also introduce currency risk. The key insight I gained was that true diversification comes from owning assets that are not highly correlated—meaning they don’t move in lockstep. When one asset class declines, another may remain stable or even increase, helping to smooth out overall portfolio performance.

Another critical factor is cash flow needs. If you’re nearing retirement and will soon rely on your portfolio for income, your allocation must prioritize capital preservation and predictable returns. In contrast, someone decades away from retirement can afford more exposure to volatile assets because they have time to recover from downturns. I began to view my portfolio not as a single entity, but as a collection of strategic components, each serving a purpose. This shift in thinking allowed me to move beyond generic advice and create a structure tailored to my actual life circumstances. Asset allocation, I realized, isn’t a set-it-and-forget-it decision. It’s an ongoing process of alignment, adjustment, and awareness.

The Hidden Problem in Fund Management: Overlap and Illusion of Diversification

One of the most eye-opening discoveries in my portfolio review was the extent of overlap among my funds. On paper, I appeared to be well diversified—owning a U.S. large-cap fund, a small-cap fund, an international equity fund, and a global growth fund. But when I dug into the underlying holdings, I found a startling truth: many of the same companies appeared across multiple funds. Apple, Microsoft, Amazon, Alphabet, and Nvidia made up a significant portion of not just one, but three of my equity funds. In fact, nearly 60% of my total stock exposure was concentrated in just ten large-cap U.S. companies, even though I thought I was spreading my risk across different regions and styles.

This phenomenon, known as fund overlap, is far more common than most investors realize. Fund names can be misleading—labels like “Global Equity” or “Emerging Markets Growth” sound distinct, but their top holdings often mirror those of broader market indexes. Many actively managed funds, in an effort to outperform benchmarks, end up stacking similar high-performing stocks. The result? Investors believe they are diversified, but in reality, they’re amplifying exposure to the same market segments. This creates a false sense of security. When those dominant stocks face a downturn—due to regulatory changes, sector-specific risks, or macroeconomic shifts—the entire portfolio can suffer at once.

To address this, I conducted a thorough analysis of each fund’s top 10 holdings and sector allocations. I used free tools provided by my brokerage and mutual fund companies to compare overlap percentages. What I found was both surprising and concerning: two of my funds had over 70% overlap in their top holdings. This wasn’t diversification—it was redundancy. Correcting this meant making deliberate choices. I consolidated overlapping funds, replacing some with low-cost index funds that offered broader, more representative market exposure. I also introduced asset classes that behaved differently, such as real estate investment trusts (REITs) and commodities, to enhance true diversification. The goal wasn’t to eliminate big-name stocks entirely, but to ensure they didn’t dominate my portfolio without my knowledge.

Building a Smarter Structure: The Role of Risk Bands and Rebalancing

Once I had a clearer picture of what I actually owned, I turned to structure. I realized that even a well-diversified portfolio can drift off course over time due to market performance. For instance, if U.S. stocks outperform bonds in a given year, their share of the portfolio grows—potentially exposing me to more risk than I intended. To prevent this, I adopted the concept of risk bands. These are predefined ranges for each asset class, such as 50%–60% in equities or 30%–40% in fixed income. If an asset class moves beyond its target range—say, stocks rise to 65%—it triggers a rebalancing action.

Rebalancing is the disciplined practice of selling assets that have grown too large and buying those that have fallen behind, bringing the portfolio back to its original allocation. At first, this felt counterintuitive. Selling winners goes against human instinct—we want to hold onto what’s performing well, hoping it will continue to rise. But rebalancing enforces a timeless investing principle: sell high, buy low. When I rebalanced after a strong stock market year, I sold a portion of my appreciated equity funds and reinvested the proceeds into underweighted areas like international bonds and cash equivalents. This not only reduced my exposure to overvalued assets but also allowed me to buy undervalued ones at lower prices.

I set a simple rule: rebalance once a year, or whenever an asset class deviates by more than 5% from its target. This frequency strikes a balance between staying on track and avoiding excessive trading. Over time, I noticed that this practice smoothed out volatility. During market downturns, my bond and cash allocations provided stability, while during recoveries, my rebalanced equity positions allowed me to participate in gains. More importantly, rebalancing removed emotion from decision-making. Instead of reacting to headlines or market swings, I followed a clear, rules-based process. It wasn’t exciting, but it was effective. Structure, I learned, is the quiet engine of long-term investment success.

Prioritizing Cost Efficiency: How Fees Quietly Kill Returns

Another major factor I had overlooked was cost. Like many investors, I paid little attention to expense ratios—the annual fees charged by mutual funds and ETFs. A fund with a 0.50% expense ratio might seem negligible, especially when compared to potential returns. But over decades, even small fees compound into massive losses of potential wealth. I ran a simulation using a simple compound growth calculator: a $100,000 investment growing at 7% annually would be worth about $387,000 after 20 years. But with a 1% annual fee, the same investment would grow to only $260,000—a difference of over $127,000. That’s not just lost return; that’s lost opportunity.

I began auditing every fund in my portfolio for cost efficiency. I compared expense ratios across similar funds and discovered that some of my actively managed funds charged over 1.25%, while low-cost index funds tracking the same benchmarks charged less than 0.10%. The performance difference? Over a five-year period, the low-cost funds matched or slightly outperformed the expensive ones. This wasn’t a fluke—decades of research show that most actively managed funds fail to beat their benchmarks after fees. I made a strategic shift: I replaced high-cost funds with low-cost index alternatives wherever possible, especially in core areas like U.S. and international equities.

Beyond expense ratios, I also examined trading costs and tax efficiency. In my taxable brokerage account, I chose funds with low turnover to minimize capital gains distributions, which can trigger tax liabilities. I consolidated accounts where possible to reduce administrative fees and avoided frequent trading, which can erode returns through commissions and slippage. These changes didn’t require bold moves or market predictions. They simply meant keeping more of my money working for me. The lesson was clear: in investing, lower costs don’t guarantee higher returns, but they significantly increase the odds. Every dollar saved in fees is a dollar that stays invested, compounding over time to build greater wealth.

Matching Funds to Goals: The Shift from Generic to Purpose-Driven Investing

One of the most transformative changes I made was shifting from a one-size-fits-all portfolio to a goal-based approach. Instead of managing a single, undifferentiated pool of money, I divided my savings into distinct buckets, each tied to a specific financial objective. I created categories such as “Emergency Fund,” “Down Payment for a New Home,” “Children’s Education,” and “Retirement.” Each bucket had its own time horizon, risk level, and investment mix.

This approach brought immediate clarity. For short-term goals—those within three to five years—I allocated funds to low-volatility assets like high-yield savings accounts, short-term bond funds, and certificates of deposit. These investments prioritize capital preservation and liquidity, reducing the risk of loss just when the money is needed. For mid-term goals, such as a home down payment in seven years, I used a balanced mix of bonds and dividend-paying stocks to seek modest growth without excessive risk. And for long-term goals like retirement, I maintained a higher equity allocation, knowing that time would smooth out market fluctuations.

The psychological benefits were just as important as the financial ones. When the market dipped, I no longer felt the urge to panic-sell because I could see that only a portion of my money—specifically, the long-term retirement bucket—was exposed to volatility. The rest was safely allocated according to its purpose. This structure also made saving more motivating. Instead of watching an abstract account balance, I could track progress toward concrete goals. Seeing my “home fund” grow month by month made the process feel tangible and rewarding. Purpose-driven investing didn’t just improve returns—it made managing money feel more meaningful and less stressful.

The Long Game: Why Consistency Beats Cleverness

After implementing these changes, I didn’t suddenly achieve market-beating returns. In fact, some years my portfolio underperformed the S&P 500. But what changed was the consistency and predictability of my results. I avoided major losses during downturns, and my gains compounded steadily over time. More importantly, my confidence grew. I no longer felt at the mercy of market swings or the latest financial trends. I had a system—one built on structure, discipline, and continuous improvement.

The biggest lesson I learned is that successful investing isn’t about being clever or chasing the next big thing. It’s about getting the fundamentals right: proper asset allocation, minimizing unnecessary costs, eliminating hidden risks like fund overlap, and aligning investments with real-life goals. These aren’t flashy strategies, but they are powerful. They work quietly, over years and decades, to build lasting wealth. I also learned the value of regular review. I now schedule an annual portfolio checkup, much like a medical exam, to ensure everything is still on track. Life changes—goals shift, time horizons evolve, and markets move. A static portfolio can quickly become misaligned.

Looking back, I wish I had made these changes sooner. But the truth is, it’s never too late to build a smarter foundation. Whether you’re in your 30s just starting out or in your 50s preparing for retirement, the principles of sound fund management remain the same. It’s not about perfection—it’s about progress. By focusing on what you can control—costs, structure, discipline—you reduce the role of luck and increase the likelihood of long-term success. Investing doesn’t have to be complicated to be effective. Sometimes, the smartest move is the simplest one: fixing what’s already there.