What I Wish I Knew Before Setting Up Our Family Trust

Imagine passing your hard-earned wealth to your kids—only to realize too late that hidden risks could unravel everything. I learned this the hard way. Setting up a family trust felt like checking a box, but without spotting the real dangers, it nearly backfired. This is how I uncovered the risks no one talks about—and built a smarter plan. What seemed like a secure solution turned out to be fragile, vulnerable to overlooked details, shifting family dynamics, and changing laws. The truth is, a trust is not a one-time task. It’s a long-term commitment that demands attention, clarity, and foresight. This journey taught me that true financial protection isn’t just about documents—it’s about preparation, communication, and vigilance.

The False Sense of Security: Why a Family Trust Isn’t a Set-It-and-Forget-It Solution

Many families believe that once a trust is signed, their estate planning is complete. This belief creates a dangerous illusion of safety. A family trust, no matter how professionally drafted, is not a self-sustaining mechanism. It requires ongoing oversight, regular updates, and alignment with evolving personal and legal circumstances. The idea that a trust automatically protects assets, avoids taxes, and prevents disputes is a myth that can lead to serious consequences. In reality, a poorly managed or outdated trust can trigger legal battles, financial losses, and emotional turmoil among loved ones.

One common misconception is that a trust eliminates all estate taxes. While certain types of trusts can reduce tax liability, especially irrevocable trusts, most revocable living trusts do not offer immediate tax benefits. The assets within a revocable trust are still considered part of the grantor’s taxable estate. Without proper structuring—such as incorporating tax-efficient strategies or leveraging exemptions—families may face unexpected tax burdens. This misunderstanding often leads people to delay or avoid more comprehensive planning, leaving their heirs exposed to avoidable costs.

Another false assumption is that a trust prevents family conflict. Legal documents can outline how assets should be distributed, but they cannot enforce emotional harmony. If beneficiaries feel excluded, treated unfairly, or left in the dark, resentment can grow—even with a perfectly written trust. Disputes often arise not from the document itself, but from poor communication, unclear intentions, or unaddressed expectations. A trust that lacks transparency or fails to account for family dynamics may become a source of division rather than unity.

Furthermore, a trust is only effective if it is properly funded. This means that assets—such as real estate, bank accounts, and investment portfolios—must be legally transferred into the trust’s name. Many families complete the trust paperwork but neglect this critical step. As a result, those assets remain outside the trust and must go through probate, defeating one of the primary purposes of establishing the trust in the first place. This oversight is surprisingly common and can delay distributions, increase legal fees, and expose the estate to public scrutiny.

Identifying Hidden Risks: The 4 Silent Threats in Most Family Trusts

Beneath the surface of many family trusts lie hidden risks that go unnoticed until it’s too late. These threats are not dramatic or sudden; they grow quietly over time, fueled by neglect and assumption. The four most common silent dangers are unclear successor trustee plans, outdated trust terms, beneficiary conflicts, and asset titling errors. Each of these can compromise the integrity of the trust and undermine its intended purpose, turning what was meant to be a protective structure into a source of stress and loss.

The first silent threat is the lack of a clear successor trustee plan. The successor trustee is responsible for managing and distributing the trust after the grantor’s passing. Yet, many families name a spouse or adult child without considering what happens if that person is unable or unwilling to serve. What if the chosen trustee becomes ill, moves away, or passes away first? Without a backup plan, the trust may face delays or require court intervention to appoint a new trustee. This can create confusion and frustration during an already difficult time. A well-structured trust includes not only a primary successor but also secondary and even tertiary options, ensuring continuity and stability.

The second threat is outdated trust terms. Life changes—marriages, divorces, births, deaths, and financial shifts—and the trust must evolve accordingly. A trust created 20 years ago may no longer reflect current family relationships or financial goals. For example, a child who was once a minor may now be an adult with different needs. A business interest may have been sold, or a new home purchased that was never added to the trust. When a trust is not updated, it can lead to unintended consequences, such as assets going to an ex-spouse or a deceased beneficiary. Regular reviews—at least every three to five years or after major life events—are essential to keep the trust relevant and effective.

The third hidden risk is beneficiary conflict. Even with clear instructions, family members may interpret the trust differently or feel that the distribution is unfair. Siblings may disagree over the timing or method of asset distribution. A child who receives less may feel slighted, especially if the reasoning was never explained. These tensions can escalate into legal disputes, draining the estate’s resources and damaging relationships. To mitigate this risk, it’s important to document the rationale behind decisions, hold family discussions, and consider appointing a neutral trustee who can act impartially.

The fourth silent threat is asset titling errors. For a trust to function, assets must be properly titled in the trust’s name. This includes real estate, bank accounts, investment accounts, and sometimes even vehicles. If an asset is not retitled, it remains outside the trust and may be subject to probate. Worse, if the trust document does not include provisions for handling newly acquired assets, those assets may not be automatically included. Families often assume that a pour-over will ensures everything is covered, but this only works if the will is valid and probate is completed. A thorough audit of all asset titles is necessary to ensure full funding and avoid gaps in protection.

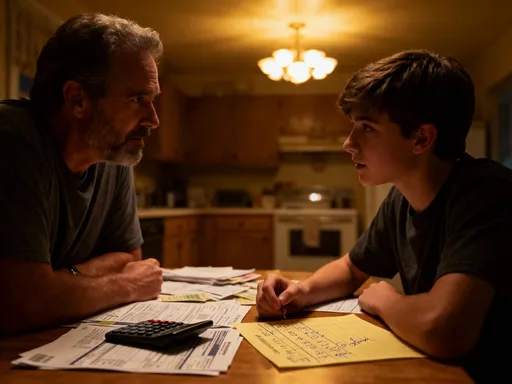

How Family Dynamics Can Break a Trust (Even with the Best Paperwork)

No legal document can fully insulate a family from emotional conflict. A trust may be perfectly written, but if it doesn’t account for human relationships, it can still fail. Family dynamics—such as sibling rivalry, perceived favoritism, or lack of communication—can turn a well-intentioned plan into a battleground. The most common trigger is when one child is named trustee over others, even if the decision is based on competence or proximity. This can breed resentment, especially if the trustee is seen as having undue influence or making unilateral decisions.

Another source of tension is unequal distribution. Parents may leave more to a child with special needs or less financial stability, which is often fair and necessary. But if the reasoning is not communicated, other siblings may interpret it as favoritism. Over time, this can erode trust and lead to disputes. Even small imbalances—such as one child receiving a family heirloom or a vacation home—can become symbolic of deeper grievances. The absence of a clear explanation can amplify misunderstandings and fuel long-standing conflicts.

To protect against these dynamics, transparency is key. Holding a family meeting to discuss the trust’s purpose, structure, and intentions can go a long way in preventing future discord. This is not about disclosing exact dollar amounts, but about sharing the values behind the decisions. Explaining why certain roles were assigned or why distributions differ helps beneficiaries understand the broader picture. It also gives them a chance to ask questions and express concerns before emotions run high.

Choosing the right trustee is another critical factor. While it may be natural to appoint a family member, this isn’t always the best choice. A neutral third party—such as a professional trustee or a trusted advisor—can provide objectivity and reduce the risk of bias. They are less likely to be influenced by personal feelings and more likely to follow the trust’s terms strictly. This can be especially valuable in blended families or situations with complex relationships. The goal is not to exclude family, but to ensure that the trustee can act in the best interest of all beneficiaries without personal conflict.

Legal Loopholes and Compliance Gaps That Put Assets at Risk

A trust is only as strong as its compliance with current laws. Legal frameworks governing estate planning change over time, and a trust that was valid decades ago may no longer meet today’s standards. Tax laws, marital regulations, and jurisdictional rules can all impact how a trust is administered. Failure to adapt to these changes can render parts of the trust unenforceable or expose assets to unnecessary risks. This is why periodic legal reviews are not optional—they are a fundamental part of responsible estate management.

One major compliance gap occurs after life events such as marriage or divorce. A trust created before a second marriage may not account for new spouses or stepchildren. In some cases, state laws automatically grant inheritance rights to a surviving spouse, even if the trust intends otherwise. Without proper safeguards—such as prenuptial agreements or updated trust terms—assets may be redirected in ways the grantor never intended. Similarly, after a divorce, former spouses may still be listed as beneficiaries or trustees if the trust is not revised, creating both legal and emotional complications.

Another area of risk is jurisdiction-specific enforcement. Trusts are governed by state law, and each state has its own rules regarding trust validity, trustee powers, and beneficiary rights. A trust established in one state may face challenges if the family moves or if assets are located in multiple states. For example, some states have more favorable asset protection laws, while others impose stricter oversight on trustees. Families with properties or financial interests across state lines should ensure their trust complies with the relevant regulations in each jurisdiction to avoid legal disputes or administrative delays.

Additionally, changes in tax legislation can affect a trust’s efficiency. Federal estate tax exemptions fluctuate, and new rules may alter how trusts are taxed or how distributions are treated. A trust designed to minimize taxes under previous laws may no longer be effective. Working with a qualified estate attorney to conduct a legal audit every few years ensures that the trust remains aligned with current regulations and continues to serve its intended purpose. This proactive approach prevents surprises and maintains the trust’s integrity over time.

Protecting Against External Threats: Creditors, Lawsuits, and Divorce

Many people assume that placing assets in a trust automatically shields them from external threats. This is only true under specific conditions. A revocable living trust, while useful for avoiding probate, offers little protection against creditors, lawsuits, or divorce claims. Since the grantor retains control over the assets, courts can still access them to satisfy debts or legal judgments. For real asset protection, families need to consider irrevocable trusts and specific legal provisions designed to limit access.

An irrevocable trust removes assets from the grantor’s estate and places them under the control of a trustee. Because the grantor no longer owns the assets, they are generally protected from personal creditors and legal actions. This can be especially valuable for professionals in high-liability fields, such as doctors or business owners. However, this protection comes at a cost—the grantor gives up control and cannot easily change the terms. Therefore, irrevocable trusts should be used strategically, with careful consideration of long-term goals and needs.

Another powerful tool is the spendthrift clause. This provision prevents beneficiaries from assigning their future trust distributions to creditors. It also protects the trust from being seized if a beneficiary faces bankruptcy or a lawsuit. Without a spendthrift clause, a beneficiary’s portion could be claimed by a divorcing spouse or a judgment creditor. Including this clause strengthens the trust’s protective function and ensures that assets are used as intended—supporting the beneficiary, not their creditors.

Real-life scenarios highlight the importance of these safeguards. Consider a beneficiary involved in a divorce. If assets are held in a revocable trust or distributed outright, they may be considered marital property and subject to division. But if the assets remain in a properly structured irrevocable trust with a spendthrift clause, they are much less likely to be included in the divorce settlement. Similarly, a beneficiary facing a lawsuit may lose personal assets, but trust distributions can remain protected if the trust is designed correctly. These protections do not happen by default—they require deliberate planning and precise legal language.

The Monitoring Trap: Why Most Families Never Review Their Trusts

One of the biggest obstacles to effective estate planning is complacency. Once the trust is signed and notarized, many families file it away and never look at it again. This is the monitoring trap—the tendency to treat estate planning as a one-time event rather than an ongoing process. The reasons are understandable: discussing death is uncomfortable, legal reviews feel like an expense, and life gets busy. But this avoidance can have serious consequences. A trust that is not reviewed regularly becomes outdated, misaligned, and potentially ineffective.

The psychological barrier is real. Talking about succession, death, and asset distribution forces families to confront mortality. Many parents delay updates because they don’t want to burden their children or appear to be making final arrangements. Others assume that if nothing has gone wrong, nothing needs to change. But estate planning is not about predicting the future—it’s about preparing for it. Just as families update insurance policies, wills, and financial plans, the trust should be part of routine financial maintenance.

A practical solution is to establish a trust review schedule. Every three to five years, the family should meet with their estate attorney to evaluate the trust’s terms, asset funding, and beneficiary designations. Key life events—such as the birth of a grandchild, a major purchase, a divorce, or a significant change in net worth—should trigger an immediate review. This proactive approach ensures that the trust evolves with the family and continues to reflect current wishes and circumstances.

Another helpful strategy is to assign a trusted advisor or family member to oversee the review process. This person can track important dates, monitor life changes, and initiate conversations with professionals. They don’t need to make decisions, but they can ensure that the process isn’t forgotten. By treating trust maintenance like a regular financial checkup, families can avoid last-minute crises and ensure that their legacy is protected with care and clarity.

Building a Resilient Trust: A Step-by-Step Risk-Proofing Strategy

Creating a strong, lasting family trust requires more than just signing documents. It demands a structured, proactive approach that addresses both legal and human factors. The goal is not just to avoid probate or reduce taxes, but to build a resilient system that protects assets, supports family harmony, and adapts over time. This final section offers a clear, step-by-step strategy to risk-proof any family trust, turning it from a static legal form into a living, dynamic safeguard.

The first step is a comprehensive risk assessment. Families should evaluate their current trust against the four silent threats: successor trustee planning, outdated terms, beneficiary conflicts, and asset titling. This involves reviewing the trust document, verifying that all assets are properly funded, and confirming that beneficiary and trustee designations are current. It also means considering family dynamics—Are there potential sources of conflict? Is communication open and transparent? This assessment provides a clear picture of vulnerabilities and priorities.

The second step is professional coordination. Estate planning involves multiple disciplines—law, finance, tax, and sometimes psychology. Families should work with a qualified estate attorney, a financial advisor, and a tax professional to ensure all aspects are covered. The attorney ensures legal validity and compliance, the financial advisor aligns the trust with investment and retirement goals, and the tax expert identifies opportunities for efficiency. Regular collaboration among these professionals strengthens the overall plan and prevents gaps in protection.

The third step is documentation and communication. All decisions, updates, and intentions should be clearly recorded. This includes written explanations for unequal distributions, trustee selection criteria, and long-term goals. Families should also consider holding regular meetings to discuss the trust, answer questions, and update everyone on changes. These conversations don’t have to be formal, but they should be consistent. Open dialogue builds trust, reduces misunderstandings, and prepares beneficiaries for their future roles.

The final step is establishing a maintenance routine. Just as a home needs repairs and a car needs service, a trust needs regular attention. Families should set calendar reminders for trust reviews, link updates to major life events, and designate a responsible person to oversee the process. This transforms trust management from an afterthought into a habit. Over time, this routine ensures that the trust remains strong, relevant, and capable of fulfilling its purpose—protecting the family’s legacy for generations to come.