What I Learned About Estate Taxes—And Why It Changed My Wealth Game

Estate taxes used to feel like a distant problem—something for the ultra-rich or future me to worry about. But when I started digging into how wealth is passed on, I realized it’s not just about inheritance; it’s about control, timing, and smart planning. What I discovered wasn’t scary legal jargon, but practical strategies that protect hard-earned assets. This is what the market reveals about estate tax moves that actually work. For many families, especially those who have built wealth steadily over decades, the idea of losing a significant portion to taxes can be unsettling. The good news is that with informed decisions, much of that loss can be avoided. This article breaks down the real impact of estate taxes, the tools available to manage exposure, and how everyday investors can take control of their legacy.

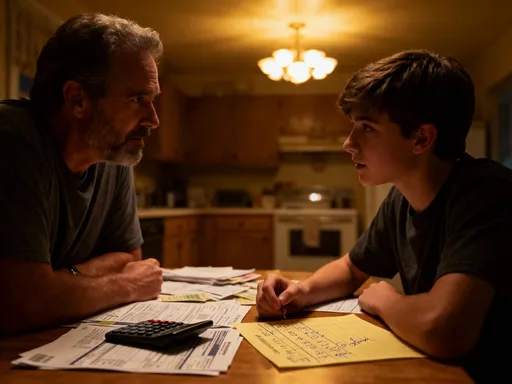

The Hidden Cost of Doing Nothing

One of the most costly financial decisions is making no decision at all. When it comes to estate planning, inaction can lead to unintended consequences that diminish the value of what’s passed on to heirs. Many individuals believe estate taxes only affect the extremely wealthy—those with multimillion-dollar portfolios or high-profile assets. However, shifting economic conditions, rising real estate values, and inflation-adjusted thresholds mean that more families than ever may fall within taxable estate ranges. According to data from the Internal Revenue Service, while only a small percentage of estates are subject to federal estate tax each year, that number is expected to grow as asset prices continue to climb. In 2023, the federal estate tax exemption stood at approximately $12.92 million per individual, but this amount is scheduled to sunset in 2026, potentially reverting to pre-2018 levels unless Congress intervenes. This means that what seems like a safe estate today could become taxable tomorrow.

The erosion of wealth due to poor planning isn’t limited to direct tax liability. Without a clear structure, families may face probate delays, legal disputes, or forced asset liquidation—all of which reduce net inheritance. Real estate, family businesses, and investment portfolios can lose value during prolonged court processes or if sold under pressure. For example, a family-owned farm worth $5 million may not generate enough annual income to cover a sudden tax bill, leading heirs to sell portions of the land at unfavorable prices. This scenario is more common than many realize, especially in rural communities where assets are substantial but liquidity is low. Market trends also suggest that home values in many regions have doubled over the past decade, pushing previously non-taxable estates into new valuation brackets. The result? A growing number of middle-market families now face estate tax considerations they never anticipated.

Additionally, demographic shifts are accelerating the need for proactive planning. The baby boomer generation is currently transferring wealth to younger generations at an unprecedented scale—an estimated $84 trillion over the next two decades, according to the Spectrem Group. This intergenerational shift means that even modest estates could be affected by compounding tax implications if not structured properly. Furthermore, changes in family dynamics, such as blended families or geographically dispersed heirs, increase the complexity of distribution and heighten the risk of conflict. Without a formal plan, personal wishes may not be honored, and assets may be divided in ways that undermine long-term financial stability. Therefore, the cost of doing nothing extends beyond tax payments—it includes loss of control, family tension, and inefficiency in wealth transfer.

How Estate Taxes Actually Work (Without the Confusion)

Understanding how estate taxes function is the first step toward effective planning. At its core, the federal estate tax applies to the transfer of a person’s assets after death. It is calculated based on the total value of the taxable estate, which includes real estate, investment accounts, business interests, life insurance proceeds, and other valuable holdings. What many people confuse is the difference between estate tax and inheritance tax. The estate tax is imposed on the estate itself before distribution, while inheritance tax is paid by the beneficiary and varies by state. As of now, the federal government does not levy an inheritance tax, but six states do: Iowa, Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania, each with its own rules and exemption levels.

The federal estate tax system operates on a progressive rate structure, with rates ranging from 18% to 40%, depending on the size of the estate. However, most estates never reach the threshold for taxation due to the generous lifetime exemption. As mentioned, this exemption allows individuals to transfer up to a certain amount tax-free, either during life or at death. Married couples can combine their exemptions through a strategy known as portability, effectively doubling the threshold. For example, in 2023, a married couple could shield up to $25.84 million from federal estate tax. It’s important to note that this exemption covers both lifetime gifts and posthumous transfers, meaning any large gifts made during life reduce the remaining exemption available at death.

Another point of confusion lies in what counts toward the taxable estate. Not all assets are treated equally. Jointly owned property with rights of survivorship typically bypasses the estate and transfers directly to the surviving owner, thus not being included in the taxable calculation. Similarly, retirement accounts with designated beneficiaries, such as IRAs or 401(k)s, pass outside of probate and are generally not part of the estate for tax purposes. However, the value of these accounts may still influence the overall estate valuation if they are large enough to push the total above the exemption limit. Life insurance proceeds are also includable in the estate if the policy is owned by the deceased, which is why many planners recommend placing such policies in irrevocable trusts to remove them from the taxable base.

Timing plays a crucial role in estate tax liability. Because tax laws are subject to change, the value of an estate at the time of death determines the applicable rules. For instance, if someone dies in 2025, their estate would be evaluated under the current higher exemption, but if they pass in 2027, the lower exemption may apply unless legislation extends the current framework. This uncertainty underscores the importance of forward-looking planning. By understanding these mechanics—what triggers the tax, how exemptions work, and which assets are counted—individuals can make informed choices that align with both financial goals and family needs.

Market Signals Every Planner Should Watch

Financial markets and regulatory environments are not static, and their fluctuations directly impact estate planning outcomes. Savvy planners pay close attention to macroeconomic indicators because they influence asset valuations, gifting strategies, and tax exposure. One of the most significant factors is the trajectory of interest rates. The federal funds rate, set by the Federal Reserve, affects everything from bond yields to borrowing costs, and it plays a critical role in certain estate planning techniques. For example, the Applicable Federal Rates (AFRs) are used to determine the minimum interest rate for intra-family loans and grantor retained annuity trusts (GRATs). When interest rates are low, GRATs become more effective tools for transferring wealth because the IRS assumes a lower return on assets, making it easier for the trust to outperform the hurdle rate and pass excess growth to beneficiaries tax-free.

Equity market performance is another key signal. During periods of strong stock market growth, concentrated portfolios—such as those heavily weighted in a single company’s shares—can see rapid appreciation. While this increases net worth, it also raises the estate’s taxable value. A sudden spike in stock prices could push an estate over the exemption threshold, triggering liability where none existed before. This is particularly relevant for individuals who hold significant positions in employer stock or private companies. Market peaks also influence gifting strategies. Many planners advise clients to make large gifts during high-valuation periods because the gift’s value is locked in at the time of transfer, potentially shielding future appreciation from estate tax. For instance, gifting appreciated stock in a rising market means that all subsequent gains occur outside the donor’s estate.

Real estate markets also send important signals. Over the past decade, residential and commercial property values have risen sharply in many parts of the country. An estate that includes rental properties or undeveloped land may find its value significantly inflated compared to earlier appraisals. Since estate tax is based on fair market value at the time of death, a sudden surge in local real estate prices could unexpectedly expose an estate to taxation. This makes regular property valuations essential. Additionally, changes in zoning laws, infrastructure development, or demographic shifts in a region can alter long-term property value projections, further complicating planning efforts. Staying informed about local market trends allows families to adjust their strategies proactively, whether through gifting, trusts, or sales.

Regulatory uncertainty is perhaps the most persistent signal. Tax laws are subject to political and economic pressures, and estate tax policy has historically been a point of debate. The current high exemption level is set to expire in 2026, and while future legislation is unknown, the possibility of a rollback looms large. Planners who monitor congressional activity and budget forecasts can anticipate potential changes and advise clients accordingly. Some experts recommend using the current window of opportunity to make large gifts or establish trusts before the exemption decreases. Others suggest structuring plans with flexibility in mind, so adjustments can be made as new laws emerge. By watching these market and policy signals, families can move from reactive to strategic planning, ensuring their wealth transfer remains efficient and resilient.

Smart Tools That Actually Reduce Exposure

Effective estate planning is not about avoiding taxes at all costs—it’s about using legal, recognized strategies to preserve wealth and ensure smooth transfer. Several proven tools have stood the test of time in reducing estate tax exposure. Among the most powerful is the use of trusts, which allow individuals to transfer assets while maintaining a degree of control. Revocable living trusts, for example, avoid probate and provide privacy, but they do not reduce estate tax liability because the grantor retains control. In contrast, irrevocable trusts—such as irrevocable life insurance trusts (ILITs) or qualified personal residence trusts (QPRTs)—remove assets from the taxable estate, making them a cornerstone of tax-efficient planning. Once assets are placed in an irrevocable trust, they are no longer considered part of the individual’s estate, and their future appreciation occurs outside the taxable base.

Gifting is another practical tool. The annual gift tax exclusion allows individuals to give up to $17,000 per recipient in 2023 without using any of their lifetime exemption. Married couples can double this amount by splitting gifts. Over time, consistent gifting can significantly reduce the size of a taxable estate. For larger transfers, individuals can elect to use part of their lifetime exemption to make gifts above the annual exclusion. This strategy is particularly useful for parents or grandparents who want to help younger generations with education, home purchases, or business startups. Importantly, once a gift is made, the asset and its future growth are no longer subject to estate tax, even if the donor passes away years later. This compounding effect makes early gifting a powerful wealth preservation technique.

Life insurance, when structured correctly, can also play a strategic role. A common issue arises when a large life insurance policy is owned by the insured—the death benefit becomes part of the taxable estate. To avoid this, many families place the policy in an ILIT. The trust owns the policy, pays the premiums, and receives the proceeds upon death, which can then be distributed to beneficiaries according to predetermined terms. This not only removes the death benefit from the estate but also provides immediate liquidity to cover tax obligations or other expenses. In cases where an estate includes illiquid assets like real estate or private business interests, this liquidity can prevent forced sales and maintain family ownership.

No single tool fits every situation. A physician with a concentrated stock portfolio may benefit from a GRAT to transfer shares without immediate tax consequences, while a business owner might use a family limited partnership (FLP) to consolidate ownership and apply valuation discounts. The key is customization. Financial advisors often combine multiple strategies—such as gifting, trusts, and insurance—to create layered protection. What matters most is starting the conversation early, gathering accurate valuations, and working with experienced professionals to implement solutions tailored to individual circumstances. These tools are not reserved for the ultra-wealthy; they are accessible and beneficial for any family seeking to protect its legacy.

When Liquidity Becomes the Real Problem

Even the most carefully designed estate plan can fail if the estate lacks sufficient liquidity to meet tax obligations. This is one of the most overlooked yet critical aspects of wealth transfer. Estate taxes are due within nine months of death, and the IRS requires payment in cash. If the estate consists largely of illiquid assets—such as real estate, private business interests, collectibles, or partnership stakes—raising the necessary funds can force heirs to sell valuable holdings at inopportune times. A family business that has operated for generations may be forced to downsize or close if there isn’t enough cash to cover the tax bill. Similarly, a rural property owner may have to divide and sell portions of farmland, disrupting long-term operations and family tradition.

The risk is particularly acute for owners of closely held businesses. These enterprises often represent the largest component of an individual’s net worth but generate limited cash flow. Valuation for estate tax purposes is based on full market value, yet converting that value into cash requires time and market conditions. If no liquidity plan exists, heirs may have to take on debt, dilute ownership by bringing in outside investors, or accept below-market offers from buyers. In some cases, disputes among heirs can further delay decisions, exacerbating financial strain. The emotional toll of losing a family legacy due to preventable cash shortages cannot be overstated.

To address this challenge, many planners recommend establishing a dedicated source of liquidity. One of the most effective solutions is an irrevocable life insurance trust (ILIT). By placing a permanent life insurance policy in the trust, families ensure that a tax-free death benefit is available precisely when needed. The proceeds can be used to pay estate taxes, settle debts, or support heirs without disrupting the core assets. Another approach is strategic asset allocation—maintaining a portion of the estate in liquid investments such as bonds, money market funds, or dividend-paying stocks. These holdings can be quickly accessed to meet obligations while preserving long-term wealth.

Some business owners also use buy-sell agreements funded with life insurance. These contracts outline how ownership will be transferred upon death and ensure that surviving partners or family members have the means to purchase the deceased’s share. This provides clarity and financial stability during a difficult time. Additionally, gifting minority interests during life can reduce the taxable estate while gradually transferring control. The key is to plan ahead, assess the liquidity needs of the estate, and implement solutions that align with both financial and personal goals. Without a liquidity strategy, even a well-structured plan can unravel under the weight of a tax bill.

The Generational Shift in Wealth Transfer

The transfer of wealth is no longer just a financial transaction—it’s evolving into a multi-generational conversation shaped by changing values, economic conditions, and market expectations. As trillions of dollars move from baby boomers to their children and grandchildren, new priorities are emerging. Younger heirs often value flexibility, access, and purpose-driven wealth management over rigid, top-down control. This shift is influencing how estate plans are designed, with greater emphasis on adaptability, transparency, and ongoing involvement. Where previous generations favored centralized control and long-term preservation, today’s beneficiaries often seek early access to capital for entrepreneurship, education, or philanthropy.

Market volatility is also reshaping planning strategies. In uncertain economic environments, families are more cautious about locking assets into inflexible structures. The use of grantor trusts, for example, has increased because they allow the grantor to pay income taxes on trust earnings, thereby reducing the estate’s size while enabling the trust to grow tax-free for beneficiaries. Step-up in basis planning has gained attention as well, particularly for appreciated assets. When an individual inherits an asset, its cost basis is adjusted to the market value at the time of death, potentially eliminating capital gains tax on decades of appreciation. This benefit makes holding certain assets until death a strategic choice, especially in high-growth markets.

Communication is becoming a central component of modern estate planning. Families that engage in open discussions about values, responsibilities, and expectations tend to experience smoother transitions. Financial literacy among heirs is also a growing focus, with many parents funding educational workshops or advisory services to prepare the next generation. This proactive approach reduces the risk of mismanagement and aligns wealth transfer with long-term family goals. As a result, estate plans are increasingly integrated with broader financial, legal, and personal development strategies, reflecting a more holistic view of legacy.

Building a Plan That Adapts—Not Breaks

Estate planning is not a one-time event but an ongoing process that must evolve with changing circumstances. Laws change, markets fluctuate, families grow, and personal goals shift. A plan created a decade ago may no longer reflect current realities or take advantage of new opportunities. Regular reviews—at least every three to five years or after major life events—are essential to ensure relevance and effectiveness. Triggers for review include marriage, divorce, the birth of grandchildren, significant changes in net worth, or shifts in tax legislation. Without periodic assessment, even the most thoughtful plan can become outdated, leading to inefficiencies or unintended outcomes.

A resilient estate plan integrates legal, financial, and family considerations. It should be structured with flexibility, allowing for amendments as needed. For example, using testamentary trusts with discretionary powers gives trustees the ability to respond to beneficiaries’ changing needs. Digital assets, such as online accounts, cryptocurrencies, and intellectual property, must also be addressed, as they are increasingly part of modern estates. Ensuring that executors and trustees have access to necessary information and authority prevents delays and confusion.

Collaboration among professionals—estate attorneys, financial advisors, accountants, and insurance specialists—ensures that all aspects are coordinated. A well-constructed plan does more than minimize taxes; it preserves family harmony, honors personal wishes, and supports long-term financial security. By treating estate planning as a dynamic, forward-looking process, families can create a legacy that endures, adapts, and thrives across generations.