How I Cut High School Costs Without Sacrificing Quality

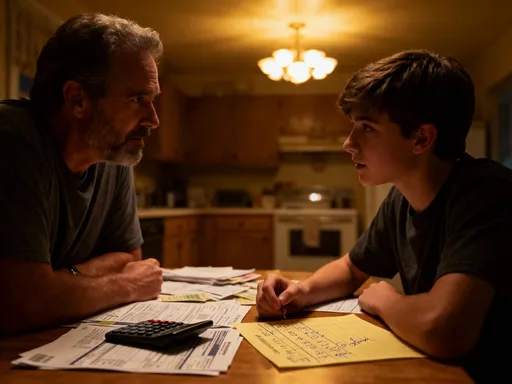

Paying for high school shouldn’t mean emptying your wallet. I’ve been there—staring at bills, stressed about extras, and wondering how families keep up. After years of trial, error, and smart adjustments, I discovered practical ways to control education costs. This isn’t about cutting corners—it’s about making informed choices. Let me walk you through the real strategies that reduced our expenses while keeping learning strong. What started as a necessity became a mission: to show that quality education doesn’t have to come with a high price tag. With careful planning, resourcefulness, and a bit of financial discipline, it’s possible to support your child’s academic journey without financial strain.

The Hidden Price of High School Education

Many families operate under the assumption that public high school is free, but the reality is far more complex. While tuition may not appear on a monthly bill, the accumulation of associated costs can place a significant burden on household budgets. These expenses often fly under the radar, dismissed as minor or one-time charges, but when tallied annually, they reveal a substantial financial commitment. From course-specific lab fees and standardized testing charges to technology requirements and extracurricular dues, the out-of-pocket costs add up quickly. For instance, Advanced Placement (AP) exams alone can cost over $100 per test, and students taking multiple exams face a bill that rivals a month’s grocery budget.

Additional hidden expenses include mandatory supplies such as graphing calculators, art materials, or science kits, which can cost hundreds of dollars if purchased new. Field trips, sometimes labeled as “optional,” often carry fees that range from $25 to $150 depending on destination and duration. Transportation costs, especially for after-school programs or competitive teams, can also contribute significantly. Then there are the social and transitional costs of senior year: cap and gown rentals, yearbook purchases, prom tickets, formal wear, and college application fees. A single application can cost $40 to $100, and applying to multiple schools multiplies that expense rapidly. Without careful tracking, these items can push a family’s annual education spending into the thousands—even in public school systems.

The emotional toll of these hidden costs should not be underestimated. Parents often feel pressured to say yes to every request, fearing their child might miss out or feel embarrassed. This pressure can lead to financial overextension, especially when multiple children are involved. The first step in gaining control is awareness. We began by collecting every receipt, tracking every payment, and categorizing each expense. This exercise revealed patterns we had previously overlooked—such as recurring monthly club dues or annual technology upgrades. Once we could see the full scope of our spending, we were better equipped to make intentional decisions. Understanding the true cost of high school is not about discouragement; it’s about empowerment. Knowledge transforms passive spending into active financial planning.

Smart Budgeting: Mapping Your Education Expenses

Creating a realistic, comprehensive budget is the cornerstone of managing high school costs effectively. Unlike general household budgeting, education-specific planning requires foresight and adaptability. The process begins with gathering data from previous academic years. Review bank statements, credit card bills, and saved receipts to identify all education-related expenditures. Categorize these into fixed costs—such as registration fees, technology fees, or mandatory insurance—and variable costs like supplies, extracurricular activities, or travel for competitions. This breakdown provides a clear picture of where money is going and helps predict future needs.

Once historical data is organized, project expenses for the upcoming year. Include known costs such as textbook fees and anticipated ones like AP exams or driver’s education. Don’t overlook one-time purchases, such as a new laptop or musical instrument, which can be budgeted over time. We found it helpful to create a rolling 12-month budget that updated monthly, allowing us to adjust for unexpected changes—such as a sudden club trip or a required software purchase. By allocating a set amount each month into an education savings account, we avoided the stress of last-minute payments and reduced the temptation to rely on credit cards.

Another effective strategy is to align budgeting with the school calendar. At the start of each academic year, we reviewed the school’s activity schedule and fee structure. This allowed us to anticipate peak spending months—typically August and September for supplies and registration, and spring for prom and college applications. By spreading costs evenly across the year, we maintained financial stability. We also built in a small contingency fund—about 10% of the total budget—to cover unforeseen expenses without disrupting other financial goals. This proactive approach not only prevented debt but also reduced anxiety. Budgeting became less about restriction and more about preparation. It shifted our mindset from reacting to costs to planning for them, giving us greater confidence and control.

Strategic Use of Secondhand and Shared Resources

One of the most impactful ways to reduce high school expenses is by rethinking the need for brand-new materials. Textbooks, uniforms, calculators, lab equipment, and art supplies are often available in excellent condition through secondhand channels. Many schools have active parent networks where families exchange or sell gently used items at a fraction of retail prices. Online platforms such as Facebook Marketplace, Nextdoor, or local buy-sell-trade groups are also valuable resources. We began sourcing textbooks this way and saved over $300 in a single year. The books were in near-new condition, and some even included helpful notes from previous students.

Uniforms and formal wear for events like prom or career day can also be found secondhand. Many families donate gently used items after their children outgrow them, creating a sustainable and affordable supply chain. We discovered that high-quality dress shoes, blazers, and even prom gowns could be purchased for 20% to 50% of their original cost. Some schools host annual “supply swap” events where students and parents exchange unused materials. These gatherings foster community while reducing waste and expense. Participating in one such event allowed us to acquire lab goggles, graph paper pads, and a scientific calculator—all for free.

Another powerful strategy is bulk sharing among families. We connected with three other parents whose children were in the same grade and agreed to purchase shared items collectively. This included expensive tools like TI-84 calculators, art kits, and robotics components. By splitting the cost, each family saved 60% to 75% on these items. We also established a rotation system so everyone had access when needed. This cooperative approach not only reduced spending but strengthened our support network. It reminded us that we weren’t alone in navigating these costs. The quality of education did not suffer—our child had everything required, on time, without financial strain. Choosing secondhand and shared resources isn’t about compromise; it’s about making smart, sustainable choices that benefit both the budget and the environment.

Leveraging Free and Low-Cost Learning Tools

The digital age has revolutionized access to educational resources, offering high-quality learning tools at little or no cost. Instead of paying hundreds for private tutoring or test prep courses, families can now turn to reputable online platforms that provide structured lessons, practice exams, and interactive exercises. Websites like Khan Academy, Coursera, and CK-12 offer comprehensive materials aligned with high school curricula, including math, science, and AP subjects. These resources are developed by educators and institutions and are freely available to anyone with an internet connection. We integrated these into our child’s study routine and saw measurable improvements in grades and test scores.

Libraries remain one of the most underutilized resources for academic support. Most public libraries offer free access to digital databases such as JSTOR, Britannica, and LearningExpress, which include practice tests for the SAT, ACT, and other standardized exams. Many also provide access to online tutoring services through partnerships with educational organizations. We took advantage of our local library’s homework help center, where certified teachers offered virtual sessions after school. This eliminated the need for a private tutor, saving over $1,000 annually. Additionally, libraries often host free workshops on college readiness, financial aid, and study skills—valuable support without the price tag.

Schools themselves often provide no-cost academic enrichment programs. After-school study halls, peer tutoring, and teacher-led review sessions are frequently available but under-enrolled. We encouraged our child to attend these instead of enrolling in commercial prep academies. Not only did this reinforce classroom learning, but it also strengthened relationships with teachers and peers. For subjects requiring extra practice, such as foreign languages or coding, we used free apps like Duolingo and Code.org. These platforms make learning engaging and accessible. The cumulative effect of using free and low-cost tools was profound: our child received robust academic support while we preserved financial flexibility. Education doesn’t have to be expensive to be effective—sometimes, the best resources are already within reach.

Managing Extracurricular Spending Without Saying No

Extracurricular activities play a vital role in a student’s development, fostering skills in leadership, teamwork, and time management. They also enhance college applications and personal growth. However, the costs associated with sports teams, music programs, debate clubs, or robotics competitions can escalate quickly. Registration fees, equipment, travel, and tournament expenses often amount to hundreds or even thousands per season. For families on a tight budget, these costs can feel prohibitive, leading to difficult choices about participation.

Rather than eliminating activities altogether, we adopted a strategic approach. First, we set a clear annual spending limit for extracurriculars—$500 per child—and prioritized based on passion and long-term value. Instead of spreading resources across multiple clubs, we focused on one or two meaningful commitments where our child showed genuine interest and potential for growth. This principle of depth over breadth allowed for deeper engagement and better outcomes. For example, staying with the science Olympiad team for all four years led to leadership roles and scholarship opportunities, whereas joining several clubs briefly would have yielded fewer benefits.

We also explored cost-reduction options within each activity. Many schools offer fee waivers or sliding-scale payments for families who qualify based on income. These programs are confidential and underused—parents should never hesitate to inquire. Fundraising initiatives, such as car washes or bake sales, often cover a portion of team expenses, reducing individual burdens. We encouraged our child to participate in these efforts, which also built a sense of ownership and community. Some programs offer equipment loans or shared resources, minimizing the need for personal purchases. By combining selective participation, financial assistance, and fundraising, we maintained full involvement without overspending. The goal wasn’t to cut out activities but to make them sustainable.

Planning Ahead for Big-Ticket Senior Year Expenses

Senior year is a milestone filled with excitement and anticipation, but it also brings a wave of high-cost obligations. Prom, graduation ceremonies, college tours, application fees, and acceptance deposits can strain even well-prepared budgets. Without advance planning, families may resort to credit cards or loans to cover these expenses, leading to post-graduation financial stress. We recognized this challenge early and began preparing in ninth grade by establishing a dedicated savings fund for senior year. Setting aside as little as $50 per month created a cushion of over $2,400 by graduation—enough to cover most major costs without strain.

We also researched affordable alternatives to traditional senior events. For prom, instead of expensive formal wear rentals and limousine services, we explored group options such as community center dances or school-organized events with lower ticket prices. Some families host potluck dinners or park gatherings, creating memorable experiences at minimal cost. For college applications, we prioritized early submissions, which not only improved acceptance chances but sometimes reduced fees. Many institutions offer application waivers for students with financial need, and counselors can assist with the process. We also limited campus visits to regional schools, using virtual tours for out-of-state options, saving on travel and lodging.

Graduation-related expenses, such as cap and gown, announcements, and senior portraits, were planned with cost-saving in mind. We purchased used regalia from previous graduates and opted for digital announcements instead of printed ones. Senior photos were taken by a skilled family friend rather than a professional studio. These choices preserved the significance of the moment without inflating the price. By starting early and making thoughtful decisions, we transformed what could have been a financially overwhelming year into a manageable and joyful celebration. Preparation didn’t diminish the experience—it enhanced it by removing financial anxiety.

Teaching Financial Awareness Through the Process

One of the most valuable outcomes of managing high school costs was the opportunity to teach financial literacy in real time. As we reviewed budgets, compared prices, and made trade-offs, we included our child in the conversations. This wasn’t about burdening them with stress but about fostering awareness and responsibility. They learned to evaluate the difference between needs and wants, to research affordable alternatives, and to appreciate the effort behind every dollar spent. Over time, these lessons translated into independent decision-making—choosing to reuse supplies, opting for a used textbook, or suggesting a low-cost prom idea.

We framed financial discussions as empowerment, not limitation. Instead of saying “we can’t afford this,” we said, “let’s find a smarter way.” This shift in language encouraged problem-solving and creativity. Our child began tracking their own spending on school-related items and set personal savings goals. They also recognized the value of non-monetary contributions, such as volunteering for event setup or helping with fundraising. These experiences built gratitude, resilience, and practical money skills that extend far beyond high school.

The process also strengthened family communication. Regular check-ins about budget progress or upcoming expenses created open dialogue about money—a topic often avoided in households. By modeling thoughtful financial behavior, we demonstrated that responsible spending isn’t about deprivation but about intentionality. The habits formed during these years laid the foundation for future financial health, from college budgeting to long-term saving. In the end, we didn’t just reduce expenses—we raised a financially aware, confident young adult ready to navigate the real world.