How I Smartened Up My Jewelry Investments—And Kept More of the Profit

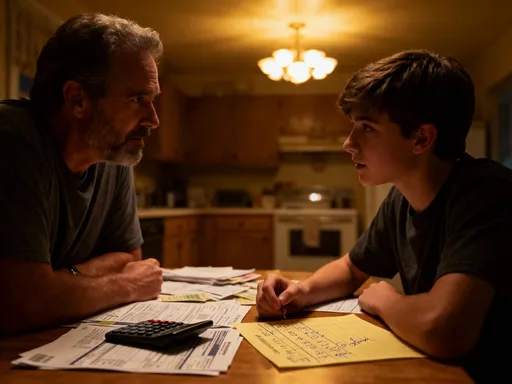

You buy a stunning piece of jewelry, not just for its beauty but as an investment. But when it’s time to sell, taxes take a surprising bite. I learned this the hard way. What started as a passion project turned into a financial lesson—especially around tax planning. Turns out, how and when you handle jewelry investments can seriously impact your returns. I didn’t realize that a $20,000 diamond pendant could trigger thousands in unexpected tax liability. It wasn’t just about finding the right piece; it was about understanding the rules behind the sale. With hindsight, I see that smart investing isn’t only about appreciation—it’s about retention. This is the story of how I turned emotional purchases into tax-smart decisions, protected my profits, and built a collection that serves both my heart and my balance sheet.

Why Jewelry? The Allure and Reality of Precious Metals and Gems

Jewelry has long occupied a unique space in the world of personal finance—not quite cash, not quite stocks, but something enduring. For many, it represents more than adornment; it’s a tangible legacy, a form of stored value passed from one generation to the next. In recent years, rising inflation and market uncertainty have driven more individuals to consider precious metals and gemstones as alternative investments. Gold, in particular, has maintained its appeal as a hedge against currency devaluation. Unlike paper assets, which can fluctuate wildly based on investor sentiment, gold holds intrinsic worth recognized across cultures and centuries. This stability is a major draw, especially during economic turbulence when traditional portfolios may waver.

But jewelry goes beyond gold. Diamonds, sapphires, emeralds, and rare colored stones have also attracted attention from collectors and investors alike. High-quality, well-documented pieces—especially those with historical significance or exceptional clarity and cut—can appreciate significantly over time. A vintage Cartier brooch or a Burmese ruby ring might double in value over two decades, outperforming certain equity indices when adjusted for risk and holding period. These items are not just beautiful; they are portable, private, and, in some cases, scarce. That scarcity drives demand, particularly among affluent buyers seeking unique assets outside mainstream financial systems.

Yet the emotional dimension of jewelry complicates its role as an investment. Many purchases are made during milestone moments—anniversaries, births, graduations—blending sentiment with financial outlay. This emotional attachment can cloud judgment. A piece may be treasured, but that does not guarantee market value. For instance, fashion-forward designs from past decades may no longer appeal to modern buyers, limiting resale potential. Similarly, custom engravings or unconventional settings can reduce liquidity. Therefore, while jewelry offers aesthetic and symbolic value, its financial performance depends on objective factors: purity, certification, brand reputation, and global market trends.

The reality is that jewelry, like any collectible, carries unique risks. It does not generate income like dividend-paying stocks or rental properties. Its value is subject to shifts in consumer taste, mining output, and even geopolitical events affecting supply chains. Additionally, the secondary market for fine jewelry is less transparent than stock exchanges. Pricing is often opaque, with wide bid-ask spreads and variability between auction houses, dealers, and private sales. Without proper knowledge, investors may overpay at purchase or undersell at exit. Understanding these dynamics is essential for anyone treating jewelry not just as a keepsake, but as part of a strategic wealth plan.

The Hidden Tax Trap: What Most Buyers Don’t See Coming

One of the most overlooked aspects of jewelry investing is taxation. Many buyers assume that because they are not trading stocks or earning interest, they are insulated from tax obligations. This misconception can lead to significant financial surprises. When you sell a piece of jewelry for more than you paid, the profit is generally considered a capital gain—and in many jurisdictions, it is taxable. In the United States, for example, the Internal Revenue Service (IRS) classifies jewelry as a collectible, which means it is subject to a higher capital gains tax rate than most other investments. While long-term capital gains on stocks are typically taxed at 15% or 20%, collectibles like jewelry, art, and coins face a top federal rate of 28%.

This difference may seem small, but over time, it can erode a substantial portion of your returns. Imagine selling a diamond necklace for $50,000 that you originally purchased for $20,000. Your gain is $30,000. At the standard 15% rate, you would owe $4,500 in taxes. But under the collectibles rate, the tax bill jumps to $8,400—a difference of $3,900. That is nearly four thousand dollars less in your pocket, simply due to classification. State taxes may add further burden, depending on your location. Yet few buyers are aware of this distinction when making their initial purchase, focusing instead on aesthetics or perceived appreciation.

A real-life case illustrates the danger of ignorance. A woman in California inherited a collection of vintage watches and brooches from her mother. Over several years, she sold select pieces through online marketplaces and local dealers, receiving payments directly into her personal bank account. She did not report these transactions, believing they were gifts and therefore tax-free. Several years later, she received a notice from the IRS flagging unusual deposits. After an audit, she was required to pay back taxes, interest, and penalties totaling over $12,000. The experience was not only financially painful but emotionally distressing. It could have been avoided with proper planning and documentation.

The key lesson is foresight. Tax liability does not begin at the point of sale—it begins at acquisition. Every decision, from how you buy to how you store records, affects your future tax position. Failing to establish a clear cost basis, neglecting to keep receipts, or selling through informal channels increases the risk of underreporting or miscalculation. Moreover, tax authorities are increasingly using data analytics and third-party reporting to track high-value transactions. Even private sales may come under scrutiny if patterns suggest regular trading activity. Therefore, treating jewelry investments with the same diligence as financial assets is not optional—it is a necessity for protecting your wealth.

Buy Smart: Choosing Pieces with Long-Term Value and Tax Efficiency

To maximize returns and minimize tax exposure, the selection process must be intentional. Not all jewelry is created equal in the eyes of the market—or the taxman. The most tax-efficient investments are those that combine strong appreciation potential with clear documentation and high liquidity. These characteristics not only support value but also simplify compliance when it comes time to report gains. The first factor to consider is **provenance**—the history and origin of the piece. Items with documented lineage, such as those from renowned designers or former royal collections, often command premium prices and are easier to authenticate. This provenance strengthens your case for value and reduces disputes over valuation during audits.

Equally important is **purity and certification**. For precious metals, this means verifying karat weight for gold or fineness for platinum. For gemstones, it involves obtaining reports from independent laboratories such as the Gemological Institute of America (GIA) or the American Gem Society (AGS). These certifications provide objective assessments of cut, color, clarity, and carat weight—critical metrics that determine market value. A certified 3-carat D-color flawless diamond will always be more liquid and valuable than an uncertified stone of similar appearance. More importantly, certification establishes a verifiable cost basis, which is essential for calculating accurate capital gains.

Liquidity is another crucial factor. The ability to sell quickly at fair market value reduces holding costs and timing risk. While rare or unique pieces may appreciate significantly, they often take longer to sell and require specialized buyers. In contrast, standard designs in high-demand categories—such as solitaire diamond engagement rings or 18-karat gold chains—are more readily absorbed by the market. This liquidity allows for greater flexibility in tax planning, enabling sellers to time exits strategically rather than being forced into rushed sales.

Working with reputable dealers and appraisers adds another layer of protection. Reputable sellers provide detailed invoices that include item descriptions, metal weights, gemstone specifications, and purchase prices. These documents serve as primary evidence of cost basis. Additionally, periodic professional appraisals—at least every five years—help track value changes and support claims of appreciation. Appraisals should be conducted by certified gemologists or members of recognized appraisal associations to ensure credibility. Together, these practices create a defensible paper trail that aligns with tax reporting requirements and reduces the likelihood of disputes with authorities.

Timing the Market (and the Taxman): When to Buy, Hold, or Sell

Just as timing affects investment returns, it also influences tax outcomes. In many countries, the length of time you hold an asset determines how it is taxed. In the U.S., for example, assets held for more than one year qualify for long-term capital gains treatment, which generally carries lower rates than short-term gains. While jewelry is capped at 28% for collectibles, holding it beyond the one-year mark still avoids the higher ordinary income tax rates—sometimes as high as 37%—that apply to short-term holdings. This makes long-term holding not just a wealth-building strategy, but a tax-minimization tactic.

Strategic timing of sales can further reduce tax exposure. One effective approach is to sell during years when your overall income is lower. A retiree, for instance, may have reduced taxable income in the early years of retirement before required minimum distributions begin. Selling a valuable bracelet during this window could result in a lower effective tax rate, even within the 28% cap. Similarly, individuals experiencing a temporary drop in income due to career transitions or sabbaticals can use the opportunity to realize gains with minimized tax impact.

Another advanced technique is **tax-loss harvesting**, typically associated with stock portfolios but applicable to tangible assets as well. If you own multiple jewelry pieces and one has declined in value—perhaps due to changing tastes or market oversupply—you may choose to sell it at a loss. That loss can then be used to offset gains from other collectibles or even other types of investments, up to certain limits. In the U.S., taxpayers can deduct up to $3,000 in net capital losses annually against ordinary income, with excess losses carried forward to future years. This strategy turns underperforming assets into tax-saving tools, improving overall portfolio efficiency.

It’s also wise to consider broader economic conditions. Gold prices, for example, often rise during periods of inflation or geopolitical instability. Selling during a price peak can lock in substantial gains. However, chasing short-term spikes without regard for tax implications can backfire. A sudden sale might push you into a higher tax bracket or trigger state-level wealth taxes in certain jurisdictions. Therefore, integrating market awareness with tax planning is essential. Consulting a financial advisor before executing a sale ensures that emotional impulses do not override strategic objectives.

Documentation as Defense: Building a Paper Trail That Protects You

If there is one practice that separates savvy investors from casual collectors, it is documentation. The IRS and other tax authorities do not accept memory or estimates when determining capital gains. They require verifiable evidence of purchase price, date of acquisition, and cost basis. Without this, you may be forced to use zero cost basis—meaning the entire sale amount is treated as gain. This worst-case scenario can turn a modest profit into a massive tax bill. Therefore, building and maintaining a comprehensive paper trail is not merely good practice; it is a financial safeguard.

The foundation of this trail is the original receipt. It should include the seller’s name, date of purchase, item description, weight of metals, gemstone details, and total price paid. Digital copies are acceptable, but physical receipts should be stored in a fireproof safe or safety deposit box. Photographs of the piece from multiple angles, especially those showing hallmarks, engravings, and unique features, add another layer of verification. These images can be particularly useful if the item is later modified, lost, or stolen.

Appraisal reports should be updated regularly, ideally every three to five years, to reflect current market values. These appraisals serve multiple purposes: insurance coverage, estate planning, and tax substantiation. When selecting an appraiser, ensure they are accredited by a recognized organization such as the American Society of Appraisers (ASA) or the International Society of Appraisers (ISA). Their reports should include detailed descriptions, comparable market analysis, and a clear statement of value. Keeping these documents organized chronologically makes them easy to retrieve during audits or estate settlements.

Digital organization tools can enhance security and accessibility. Cloud storage with strong encryption allows you to back up files while maintaining control over access. However, avoid public platforms or unsecured email for sharing sensitive documents. A dedicated folder structure—organized by item, date, and document type—ensures clarity. For high-value collections, some investors create a master inventory log that includes purchase dates, costs, appraisal values, and storage locations. This level of diligence not only protects against tax risk but also simplifies management for heirs and executors.

Beyond the Sale: Gifting, Inheriting, and Passing Wealth Tax-Smart

Jewelry often transcends financial value, becoming a cherished heirloom. But transferring it to the next generation involves more than sentimental intent—it requires careful tax planning. In many countries, gifting valuable jewelry during your lifetime can trigger gift tax implications if the value exceeds annual exclusion limits. In the U.S., for example, individuals can gift up to $17,000 per recipient per year (as of 2023) without filing a gift tax return. Larger gifts may require reporting and could reduce your lifetime exemption, currently over $12 million. While no tax may be due immediately, failing to file when required can result in penalties and complications later.

One advantage of gifting is the potential to shift future appreciation to the recipient. If you give a gold necklace worth $20,000 to your daughter today, and it grows to $40,000 over ten years, the gain occurs in her hands. Depending on her tax bracket and holding period, she may pay less when she eventually sells. However, she also inherits your cost basis—meaning if she sells soon after receiving it, she could face a large gain. To avoid this, some families choose to transfer jewelry shortly before the recipient sells it, allowing them to benefit from a stepped-up basis in certain jurisdictions.

Inheritance rules vary, but in some countries, beneficiaries receive a **stepped-up basis**, meaning the cost basis is reset to the market value at the time of the owner’s death. This can eliminate capital gains tax entirely if the item is sold soon after. For example, if you bought a sapphire ring for $10,000 and it’s worth $50,000 when you pass away, your heir’s cost basis becomes $50,000. Selling it for $52,000 results in only $2,000 in taxable gain—far less than if they had inherited the original basis. This rule makes holding jewelry until death a tax-efficient strategy for wealth transfer.

Informal transfers—such as handing a brooch to a grandchild without documentation—can create problems. Without a clear record of the gift, tax authorities may question whether the transfer was a sale, loan, or inheritance. This ambiguity increases audit risk and can lead to disputes over valuation and timing. To prevent this, even personal gifts should be accompanied by a simple letter or note stating the nature of the transfer, date, and item description. While not legally binding in all cases, such records demonstrate intent and support transparency.

Building a Balanced Approach: Jewelry in Your Broader Financial Picture

Jewelry should not be viewed in isolation. It is most effective when integrated into a diversified financial strategy. While it offers unique benefits—tangibility, privacy, aesthetic pleasure—it also comes with limitations. Unlike stocks or bonds, it does not produce regular income. It requires secure storage, insurance, and maintenance. Valuation is subjective and can vary between experts. During economic downturns, luxury goods may depreciate even as other assets recover. Therefore, financial advisors often recommend limiting jewelry and collectibles to no more than 5% to 10% of a total investment portfolio.

Diversification remains the cornerstone of risk management. Allocating funds across asset classes—equities, fixed income, real estate, and alternative investments—helps smooth returns and reduce volatility. Within that framework, jewelry can serve as a hedge against inflation and currency risk, particularly when held in the form of bullion or high-purity gold coins. However, speculative buying—such as purchasing rare gems based on hype—should be approached with caution. Market sentiment can shift rapidly, and illiquid assets may be difficult to monetize when needed.

Consulting with professionals who understand both finance and tangible assets is critical. A certified financial planner (CFP) can help align your jewelry holdings with overall goals, while a tax advisor can ensure compliance and optimize reporting. An estate attorney can assist in structuring transfers to minimize tax and legal complications. These experts work together to create a cohesive plan that balances emotion with economics, ensuring that your collection enhances—not endangers—your financial well-being.

Investing in Beauty, Saving in Strategy

Jewelry occupies a rare intersection of art and asset. It carries memories, marks milestones, and often becomes part of a family’s story. But when approached with discipline, it can also be a powerful tool for wealth preservation. The real measure of success is not just how much a piece appreciates, but how much of that gain you get to keep. Smart tax planning, meticulous record-keeping, and strategic timing transform emotional purchases into intelligent financial decisions. By understanding the rules, respecting the risks, and seeking expert guidance, you can build a collection that is not only beautiful but resilient. In the end, the most valuable trait of any investor is not luck—but foresight.