How I Survived a Debt Crisis and Found My Investment Mindset

What happens when your debts feel like a collapsing house of cards? I’ve been there—awake at 3 a.m., staring at bills, wondering how I got so deep. But in that chaos, I discovered something unexpected: the real shift wasn’t about money, it was about mindset. This is the story of how I rebuilt not just my finances, but my entire approach to investing—starting from rock bottom. It wasn’t a single decision or a lucky break that turned things around. It was a slow, deliberate process of changing how I thought about money, risk, and my own ability to grow. And that change didn’t just help me survive—it helped me build a future I once thought impossible.

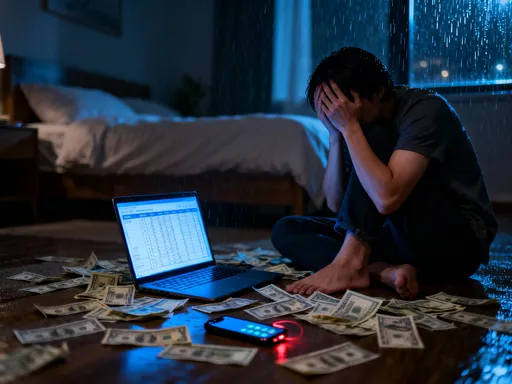

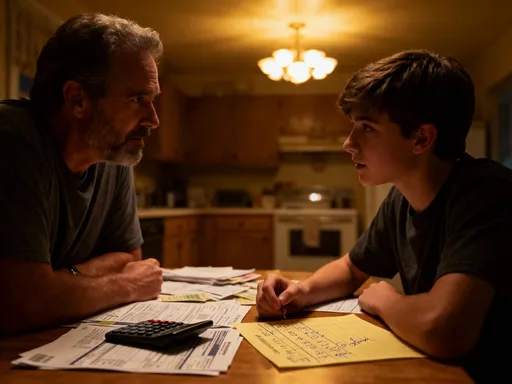

Hitting Rock Bottom: The Day My Debt Caught Up With Me

It was a Tuesday morning when everything stopped. The phone rang—again. Another automated message from a credit card company, another reminder about a past-due balance. I didn’t answer. Instead, I sat on the edge of my bed, hands shaking, staring at a spreadsheet I had opened the night before. Numbers I had ignored for months now stared back at me: $27,000 in credit card debt, two personal loans, and a medical bill I still hadn’t paid. The total was more than half my annual income. I felt like I was drowning, and the surface was getting farther away.

This wasn’t how I imagined my life. I had a stable job, a modest apartment, and no major luxuries. But years of small overspending—eating out more than I should, using credit for emergencies, ignoring my monthly statements—had snowballed into something I could no longer control. I had no emergency fund. No real budget. Just a growing sense of shame and isolation. I stopped answering calls from family, avoided opening mail, and lied to friends about why I couldn’t join them for dinner. The weight wasn’t just financial—it was emotional, psychological, and deeply personal.

The turning point came not with a solution, but with a realization: I could not keep living this way. I wasn’t lazy or irresponsible by nature, but I had developed habits that were quietly destroying my future. That morning, I made a promise to myself—not to fix everything overnight, but to stop pretending it wasn’t happening. I printed out every statement, listed every debt, and wrote down my income. It was the first time I had looked at the full picture without looking away. And in that moment, the path forward began—not with money, but with honesty.

From Panic to Planning: Why Mindset Matters More Than Money

Most financial advice starts with numbers: cut your spending, increase your income, pay down debt in order of interest rate. These are sound strategies, but they assume you’re already in a place to act. What if you’re not? What if the mere thought of opening your bank app makes your heart race? That’s where mindset becomes the real foundation. I learned that my financial crisis wasn’t caused by a single bad decision—it was the result of a series of small, repeated choices shaped by fear, avoidance, and a lack of confidence.

I had fallen into what many do: using credit cards as a temporary fix for long-term gaps. When my car needed repairs, I charged it. When I got sick, I put the co-pay on plastic. Each time, I told myself I’d pay it off soon. But without a safety net, each new expense pushed me deeper. I also used shopping as a way to cope—small purchases that gave me a brief sense of control or comfort. I didn’t realize it at the time, but I was engaging in what experts call “retail therapy,” a common emotional response to stress. The problem wasn’t the occasional purchase—it was the pattern of using money to manage feelings.

What changed wasn’t a new budgeting app or a raise at work. It was a shift in how I saw myself. I stopped thinking in terms of failure and started thinking in terms of learning. Instead of asking, “Why am I so bad with money?” I began asking, “What habits got me here, and what can I do differently?” This subtle change in language made a huge difference. It moved me from shame to curiosity, from helplessness to agency. I realized that financial health isn’t about perfection—it’s about progress. And progress starts with the belief that you’re capable of change.

Patience became my new priority. I accepted that rebuilding would take time. I focused on small wins: paying one bill on time, tracking my spending for a full week, resisting the urge to buy something I didn’t need. Each success, no matter how small, reinforced the idea that I was in control. I wasn’t fixing my finances in a day, but I was building a new relationship with money—one based on awareness, intention, and self-trust.

The First Real Move: Building a Safety Net Before Paying a Dime

One of the most counterintuitive lessons I learned was this: before I aggressively paid down debt, I needed to build a small emergency fund. Most advice says to throw every extra dollar at your highest-interest debt. But I had tried that before—and failed. Why? Because life kept happening. A flat tire. A prescription. A broken appliance. Each unexpected cost forced me to use credit again, erasing any progress I had made. I was stuck in a cycle: pay down, then borrow back.

So this time, I did something different. I committed to saving $500—just enough to cover a minor emergency—before I focused on debt repayment. It wasn’t much, but it was a start. I cut non-essentials: canceled unused subscriptions, cooked at home every night, and stopped buying coffee on the way to work. I sold old electronics, clothes, and furniture online. I redirected any windfall—a tax refund, a birthday check—into this fund. It took four months, but I got there.

That $500 didn’t earn interest or make me rich. But it gave me something far more valuable: peace of mind. When my laptop stopped working six months later, I didn’t panic. I used part of the fund to repair it. I didn’t add to my debt. That single act changed everything. It proved I could handle surprises without falling apart. It reduced my anxiety, which in turn made it easier to stick to a budget and make rational decisions. The safety net wasn’t just financial—it was psychological. It gave me the confidence to keep going.

Once the fund was in place, I felt more in control. I could see a path forward. I wasn’t just reacting to crises; I was planning for them. This shift in behavior was more important than the amount saved. It taught me that financial stability isn’t about how much you earn or how fast you pay off debt—it’s about creating systems that protect you from setbacks. And that protection starts with a simple truth: you can’t build a future if you’re always putting out fires.

Debt Isn’t the Enemy—Mismanagement Is

For years, I saw debt as a moral failing. If I had debt, I told myself, it meant I was weak, undisciplined, or irresponsible. But the truth is more nuanced. Debt itself is neutral. It’s a tool—like a knife or a car. Used wisely, it can help you grow. Used poorly, it can cause harm. The real issue isn’t the debt; it’s how you manage it.

I began to categorize my debts not by balance, but by type and cost. High-interest credit card debt—charging 22% or more—was clearly toxic. It grew faster than I could pay it down. Medical bills with no interest and flexible payment terms were less urgent. A personal loan at 8% was manageable, especially if it helped me consolidate higher-cost debt. This simple act of sorting helped me see my situation clearly. I stopped feeling overwhelmed by the total number and started seeing a roadmap.

I created a “debt map”—a simple chart listing each debt, its balance, interest rate, minimum payment, and emotional weight. Some debts made me anxious just to look at them. Others felt neutral. I used this map to prioritize: first, the high-interest, high-stress debts. I didn’t ignore the others, but I focused my energy where it would have the most impact. This wasn’t just a financial strategy—it was a psychological one. By taking control of the narrative, I reduced the fear.

I also negotiated. I called credit card companies and asked for lower interest rates. In two cases, they agreed. I looked into debt management plans through nonprofit credit counseling agencies and learned about balance transfer options. I didn’t take on new debt, but I used existing tools to reduce the cost of what I already owed. The goal wasn’t to erase debt overnight, but to make it manageable. And in that process, I stopped seeing myself as broken. I saw myself as someone solving a problem—one step at a time.

Investing While in Debt? Yes—Here’s How I Started Small

Most financial advice says to wait until you’re debt-free before investing. But I didn’t want to wait ten years. I needed to rebuild my relationship with money now. So I did something unconventional: I started investing while still paying off debt. Not large amounts—just $25 a month at first. But it was a signal to myself: I was not just surviving; I was planning for the future.

I opened a low-cost brokerage account and set up automatic transfers. Every payday, $25 went into a diversified index fund. I chose funds that tracked the broader market, so I wasn’t trying to pick winners. I didn’t watch the balance daily. I didn’t panic when the market dipped. I treated it like a habit—something I did consistently, regardless of results. Over time, that small amount grew. More importantly, my mindset grew with it.

Investing wasn’t about getting rich. It was about restoring trust—in the market, yes, but more importantly, in myself. It reminded me that I was more than my debt. I was someone who could plan, save, and believe in long-term growth. I also contributed to my employer’s retirement plan, especially if there was a match. That free money was too valuable to ignore. Even with debt, I made sure not to miss out on it.

I kept my expectations realistic. I didn’t expect 20% returns. I expected consistency. And that’s what I got. The power wasn’t in the amount—it was in the act. By investing early, I gave myself the gift of time. Compound growth doesn’t require large sums; it requires time and regular contributions. I was no longer just paying for the past. I was building for the future.

Risk Control: Protecting Progress Without Paralysis

Fear of loss is one of the biggest barriers to financial growth. I felt it every time I added money to my investment account. What if the market crashed? What if I lost everything? These fears were real, but they were also exaggerated. I learned that risk isn’t something to avoid completely—it’s something to manage.

I used diversification as my first line of defense. Instead of putting all my money into one stock or sector, I spread it across different asset classes. Index funds helped me do this automatically. I also paid attention to my time horizon. Since I wasn’t planning to withdraw the money for decades, short-term fluctuations mattered less. I reminded myself that volatility is normal. Markets go up and down. The key is to stay in the game.

I made mistakes. Early on, I panicked during a market dip and sold part of my portfolio. I locked in a loss and missed the recovery. It hurt, but it taught me a valuable lesson: emotional decisions rarely lead to good outcomes. I created simple rules to prevent this: no selling during a downturn, no chasing hot stocks, no checking my balance more than once a month. These rules gave me structure and reduced anxiety.

I also accepted that I couldn’t predict the future. No one can. Instead of trying to time the market, I focused on time in the market. I kept investing regularly, regardless of headlines. I wore my financial seatbelt—diversification, low fees, long-term focus—and kept driving forward. Risk wasn’t gone, but it was under control. And that made all the difference.

The Long Game: How Small Shifts Built Real Wealth

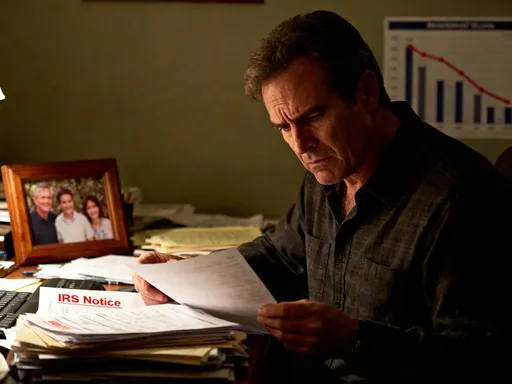

Today, my financial life looks nothing like it did five years ago. I’m not a millionaire. I don’t drive a luxury car or live in a mansion. But I sleep better. I open my bank app without fear. I have savings. I’m on track to pay off my last debt in two years. And I’m investing consistently for retirement.

The changes weren’t dramatic. They were small, repeated actions: saving $50 a month, cutting one unnecessary expense, increasing my retirement contribution by 1%. But over time, these habits compounded—just like money. The real wealth I’ve built isn’t just in my accounts. It’s in my confidence, my discipline, and my ability to handle uncertainty.

I no longer see myself as someone who’s bad with money. I see myself as someone who learned. I made mistakes, but I didn’t let them define me. I took responsibility, sought solutions, and stayed consistent. The market didn’t make me rich. Time, patience, and behavior did.

And that’s the most important lesson: financial freedom isn’t a destination. It’s a practice. It’s the daily choice to spend less than you earn, to save before you spend, to invest even when it feels too soon. It’s not about being perfect. It’s about showing up, again and again, with a mindset focused on growth.

Recovering from a debt crisis isn’t about one big win. It’s about a series of small, smart choices fueled by a stronger mindset. The real investment wasn’t in stocks or funds—it was in self-trust. And that’s the foundation no market can shake.