What Your Will Planning Actually Says About Your Future

You’ve worked hard to build your life—your home, savings, and family. But have you thought about what happens when you’re no longer around to protect it? Will planning isn’t just about signing a document; it’s about making sure your wishes are clear, your loved ones are cared for, and your assets don’t get lost in legal confusion. I’ve seen people overlook this, only to regret it later. Without a plan, the state decides who inherits, how much they receive, and when. This can lead to family tension, delays, and outcomes you never intended. The truth is, will planning isn’t about death—it’s about life, responsibility, and love.

Why Will Planning Matters More Than You Think

Many people believe that will planning is only for the wealthy or elderly. This is a myth. In reality, every adult with assets, dependents, or even digital accounts should have a will. A will is a legal document that outlines how your property should be distributed after your passing. It allows you to name beneficiaries, appoint guardians for minor children, and designate an executor to manage your estate. Without one, state laws—known as intestacy laws—take over, and they don’t consider your personal relationships or values. The result can be a distribution that doesn’t reflect your true intentions.

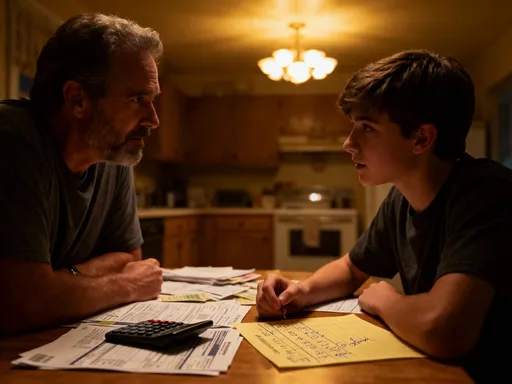

Consider the emotional toll on families left without guidance. When there’s no will, siblings may argue over heirlooms, children may be placed under guardianship that parents never approved, and long-term partners may be excluded entirely if not legally married. These conflicts are not rare. Courts often become involved, which increases stress and costs. The average probate process can take anywhere from six months to over two years, depending on the state and complexity. During that time, assets are frozen, bills go unpaid, and families face financial instability.

Will planning also brings emotional security. It’s not just about who gets the family home or the vacation cabin. It’s about knowing your children will be raised by someone you trust, that your spouse won’t face unnecessary legal hurdles, and that your charitable wishes are honored. This sense of control can be deeply comforting. Studies show that individuals who complete estate planning report lower anxiety about the future and greater peace of mind. It’s not about fearing the unknown—it’s about preparing for it with care and clarity.

Furthermore, a will is not a one-time task. Life changes—marriages, divorces, births, and relocations—can all affect its relevance. A plan made in your 30s may not reflect your situation in your 50s. Regular reviews ensure your will stays aligned with your life. Many financial advisors recommend reviewing your estate plan every three to five years, or after any major life event. This proactive approach helps avoid outdated instructions that could cause confusion or conflict later.

The Hidden Risks of Skipping the Paperwork

Putting off will planning might seem harmless in the short term, but the long-term risks are significant. One of the most common oversights is failing to update a will after major life changes. For example, a woman who divorces but never removes her ex-spouse as a beneficiary may unintentionally leave her estate to someone she no longer wants to inherit. In some states, divorce automatically revokes certain provisions, but this is not universal. Relying on assumptions can lead to unintended outcomes.

Another hidden risk involves digital assets. Today, people own more than physical property—they have online accounts, social media profiles, cryptocurrency wallets, and subscription services. These digital footprints often hold financial or sentimental value. Yet, most wills don’t address them. Without clear instructions, families may not know how to access or manage these accounts. Some platforms have strict privacy policies that prevent access even to immediate family members. This can result in lost funds or the permanent loss of cherished memories stored in photo albums or messages.

Guardianship decisions are another area where silence speaks volumes. Parents of young children often focus on saving for college or buying a home but delay naming a guardian in their will. If both parents pass away without a designation, the court decides who raises the children. This process can be slow and influenced by factors unrelated to the parents’ wishes. Relatives may compete for custody, and the court’s primary concern is legal eligibility, not emotional bonds or parenting style. A clearly stated guardianship choice in a will gives the court strong guidance and honors the parents’ intent.

Blended families face unique challenges. When one or both partners have children from previous relationships, inheritance disputes can arise. Without a carefully structured will, stepchildren may be unintentionally excluded, or biological children may feel their share is threatened. This can create lasting resentment. Clear language in the will, possibly combined with trusts, can help ensure fairness and reduce the chance of conflict. The goal is not to predict every emotional reaction but to provide a framework that reflects intention and care.

Types of Wills: Which One Fits Your Life?

Not all wills are the same. The right type depends on your personal circumstances, family structure, and financial goals. The most common is the simple will, ideal for individuals with straightforward estates—such as a home, a car, and some savings. It clearly states who gets what and names an executor. For many middle-income families, this is sufficient. It’s cost-effective, easy to understand, and covers the basics of asset distribution and guardianship.

A testamentary trust will is more complex but useful for parents with young children or those who want to control how and when assets are distributed. This type of will creates a trust upon death, managed by a trustee. For example, a parent might specify that their child receives half the inheritance at age 25 and the rest at 30. This prevents a large sum from being handed to a young adult all at once. It also protects the assets if the beneficiary faces financial difficulties, such as debt or divorce.

Joint wills are typically used by married couples who want to leave everything to each other and then to their children. While convenient, they come with limitations. Once the first spouse dies, the will becomes irrevocable, meaning the surviving spouse cannot change it—even if circumstances change. This lack of flexibility can be problematic. For instance, if the surviving spouse remarries or has a falling out with the children, they’re still bound by the original terms. For most couples, separate wills offer more control and adaptability.

Living wills, sometimes confused with last wills, are actually advance healthcare directives. They don’t deal with property but outline your wishes for medical treatment if you become incapacitated. While not a substitute for a last will, it’s an important part of a complete estate plan. Together, these documents ensure that both your financial and personal decisions are respected. Choosing the right type of will isn’t about complexity—it’s about alignment with your life stage and values.

Trusts vs. Wills: Clearing the Confusion

One of the most common questions in estate planning is whether to use a will, a trust, or both. While both serve to distribute assets, they work differently. A will takes effect after death and must go through probate—a court-supervised process that validates the document and oversees distribution. Probate can be time-consuming and public, meaning anyone can access the details of your estate. This lack of privacy can be a concern for families who value discretion.

Trusts, on the other hand, can avoid probate entirely. A revocable living trust, for example, allows you to transfer assets into the trust while you’re alive. You remain the trustee and can manage the assets as usual. When you pass away, the successor trustee distributes the assets according to your instructions—without court involvement. This can speed up the process, often reducing transfer time to a few weeks instead of months or years.

Another advantage of trusts is privacy. Unlike wills, trusts are not filed with the court, so the details remain confidential. This can be especially valuable for families with significant assets or those who wish to keep their financial affairs private. Trusts also offer more control over how assets are used. For instance, you can set conditions—such as requiring funds to be used only for education or healthcare—ensuring your legacy supports your values.

However, trusts are not always necessary. They typically cost more to set up and require ongoing management, such as retitling accounts and property. For individuals with modest estates or simple family structures, a will may be sufficient. The key is to weigh the benefits against the effort and cost. A financial advisor or estate attorney can help determine whether a trust makes sense based on your net worth, family dynamics, and long-term goals. The goal isn’t to follow a trend but to choose the tool that best serves your needs.

Choosing the Right Financial Products to Support Your Plan

A will is just one piece of the puzzle. To ensure your plan works as intended, you need to align it with the right financial products. These tools work alongside your will to streamline distribution and protect your beneficiaries. One of the most important is life insurance. A policy can provide immediate funds to cover funeral costs, debts, or living expenses for your family. It’s especially valuable for parents or breadwinners who want to ensure financial stability after their passing. The death benefit is typically paid quickly and bypasses probate, making it a reliable source of support.

Payable-on-death (POD) accounts are another useful tool. These bank or investment accounts allow you to name a beneficiary who automatically inherits the funds upon your death. They’re simple to set up and avoid probate, making them ideal for smaller assets like savings accounts or certificates of deposit. Similarly, transfer-on-death (TOD) registrations for stocks and bonds offer the same benefit for investment portfolios. These designations override what’s written in a will, so it’s crucial to keep them updated.

Joint ownership is commonly used for homes, vehicles, and bank accounts. When one owner dies, the asset automatically passes to the surviving owner. This can be helpful for married couples, but it comes with risks. Adding someone as a joint owner gives them immediate access and control, which could lead to misuse. It also exposes the asset to the co-owner’s creditors. For example, if your child is added to your bank account and later faces a lawsuit, those funds could be at risk. Careful consideration is needed before making such changes.

Retirement accounts like IRAs and 401(k)s have their own rules. They allow you to name beneficiaries directly, and those designations take precedence over your will. This means that even if your will says your cousin should inherit your savings, the retirement account will go to the person named on the beneficiary form. It’s essential to review these forms regularly, especially after life changes. Failing to do so can result in outdated or incorrect distributions, undermining your entire plan.

How to Avoid Common Product Traps

Even with the best intentions, people make mistakes when selecting financial products for estate planning. One of the most frequent errors is failing to coordinate beneficiary designations. For example, someone might name their spouse as the sole beneficiary on a retirement account but later divorce and remarry. If they don’t update the form, the ex-spouse still receives the funds—even if the new will says otherwise. This kind of oversight can lead to legal disputes and financial loss.

Tax implications are another area where mistakes happen. Large inheritances, especially from retirement accounts, can trigger significant income taxes for beneficiaries. Non-spouse heirs, for instance, must withdraw funds from inherited IRAs within 10 years under current rules, which could push them into a higher tax bracket. Planning ahead—such as converting traditional IRAs to Roth accounts over time—can reduce this burden. Understanding these rules helps families avoid unpleasant surprises.

Another trap is overcomplicating the plan. Some people create multiple trusts or add too many conditions, thinking it adds control. But excessive complexity can confuse executors and increase administrative costs. It may also lead to errors in execution. A simpler, well-organized plan is often more effective. The goal is clarity, not control over every detail. Working with a qualified professional can help strike the right balance.

Finally, many people rely on outdated or generic templates found online. While these may seem convenient, they often don’t account for state-specific laws or individual circumstances. A will that’s valid in one state may not be recognized in another. Using a template without customization can result in invalid provisions or unintended consequences. It’s worth investing in personalized advice to ensure your documents are legally sound and fully aligned with your goals.

Putting It All Together: A Step-by-Step Approach

Building a comprehensive estate plan doesn’t have to be overwhelming. Start by taking inventory of your assets—your home, savings, investments, insurance policies, and personal property. List your dependents and consider who would need financial support or guardianship. This foundation helps you understand what needs to be included in your plan.

Next, decide which documents you need. Most people benefit from a last will, a durable power of attorney, and an advance healthcare directive. If you have minor children, include guardianship appointments. If you own significant assets or want to avoid probate, consider a revocable living trust. Choose financial products that support your goals—life insurance for income replacement, POD accounts for liquidity, and proper beneficiary designations for retirement funds.

Once the documents are drafted, review them with a qualified attorney or financial advisor. They can spot potential issues, ensure compliance with state laws, and suggest improvements. Don’t view this as a sales opportunity—view it as a safety check. Just as you’d have a mechanic inspect a car before buying, having a professional review your plan increases its reliability.

Finally, commit to regular reviews. Life changes, and so should your plan. Update your will after marriage, divorce, the birth of a child, or a major move. Reassess beneficiary designations after financial changes or family events. Keep digital asset instructions current. Treat your estate plan as a living document—one that evolves with your life. This ongoing attention ensures that your wishes remain clear and effective, no matter what the future holds.

Peace of Mind Is the Ultimate Return

At its core, will planning is not about money or legal formalities. It’s about care, responsibility, and love. It’s the final act of protection for the people you cherish most. The real return on this effort isn’t measured in dollars—it’s found in the relief a spouse feels knowing they won’t face legal battles, in the security a child has knowing they’ll be cared for, and in the dignity of leaving a legacy that reflects your values.

Too many people delay this task, thinking it’s too complicated or too morbid. But the truth is, avoiding it creates far greater stress for those left behind. A well-structured plan brings clarity in uncertain times. It reduces conflict, speeds up recovery, and honors your life’s work. It allows your family to focus on healing, not paperwork.

In the end, what your will planning says about your future is this: you cared enough to prepare. You took responsibility. You thought ahead. And in doing so, you gave your loved ones one of the greatest gifts—peace of mind. That’s not just smart finance. It’s an act of lasting love.