How I Tamed Retirement’s Toughest Cost—My Investment Rhythm That Actually Works

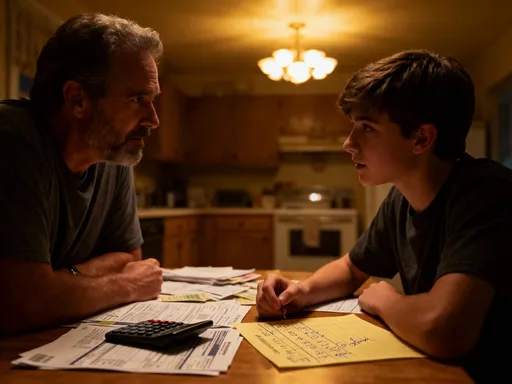

What if the biggest threat to your retirement isn’t running out of money—but how quietly nursing costs can drain your savings? I didn’t see it coming either. Despite solid plans, I underestimated long-term care expenses until reality hit. This isn’t about panic; it’s about preparation. Here’s how I reshaped my investment strategy not for quick wins, but for steady, resilient growth that aligns with real-life risks—because protecting your future means staying in rhythm, not chasing returns. It’s easy to focus on market gains or Social Security timing, but the real test of a retirement plan emerges when life changes. And few changes are as quietly disruptive as the need for long-term care. The truth is, most people don’t plan for it—not because they don’t care, but because they don’t see it coming. This article shares a practical, disciplined approach to financial resilience: an investment rhythm designed not to beat the market, but to outlast life’s surprises.

The Hidden Elephant in the Retirement Room: Nursing Costs No One Talks About

Long-term care is one of the most predictable yet overlooked expenses in retirement planning. While many envision their golden years filled with travel, family time, and leisure, few anticipate the likelihood of needing ongoing assistance with daily living. According to widely cited data from the U.S. Department of Health and Human Services, about 70% of people turning 65 today will require some form of long-term care during their lives. This care may include in-home support, assisted living, or nursing facility stays, with average costs ranging from $50,000 to over $100,000 per year depending on location and level of care. These figures are not outliers—they represent a growing reality for aging populations across developed countries.

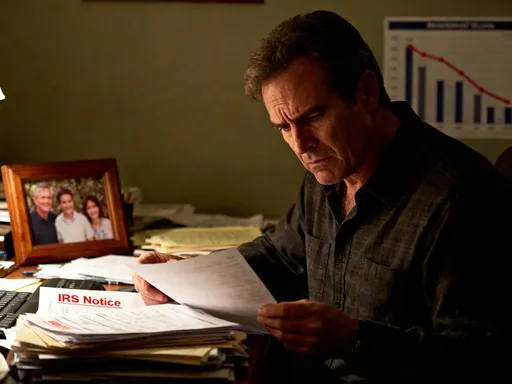

What makes long-term care so financially dangerous is not just its cost, but its timing and unpredictability. Unlike a home mortgage or car loan, these expenses typically emerge later in retirement, often after age 75, when income sources are fixed and portfolio flexibility is limited. At this stage, retirees are no longer contributing to savings and may be relying on withdrawals from investments to cover living expenses. Introducing a new, substantial cost at this point can severely strain even well-funded portfolios. For example, a couple needing two years of assisted living at $7,000 per month would face a $168,000 expense—equivalent to withdrawing nearly 6% annually from a $300,000 portfolio, far exceeding the commonly recommended 4% rule.

Yet traditional retirement planning models often ignore this risk or treat it as an afterthought. Most financial projections assume relatively stable annual spending, with modest increases for inflation. They rarely incorporate a sudden doubling of expenses due to health-related needs. This oversight creates a false sense of security. The result? Many retirees discover too late that their savings, while sufficient for everyday life, are not structured to absorb such shocks. The danger lies not in the expense itself, but in the lack of preparation for its impact on cash flow, investment behavior, and emotional decision-making.

Moreover, long-term care costs are not one-time events but ongoing obligations. Unlike a medical emergency covered by insurance, most long-term care services are paid out of pocket. Medicare provides limited coverage for skilled nursing care, but only under specific conditions and for short durations. Medicaid may cover long-term care for those with limited assets, but qualifying often requires significant financial restructuring. Private long-term care insurance exists, but uptake remains low due to high premiums, complex policies, and uncertainty about future needs. As a result, the burden falls directly on personal savings and family support. This makes it imperative to integrate long-term care planning into the core of retirement strategy—not as an add-on, but as a central consideration.

Why Traditional Retirement Planning Falls Short

The standard retirement planning model follows a familiar formula: save consistently during working years, invest in a diversified portfolio of stocks and bonds, retire at 65, and withdraw 4% annually, adjusting for inflation. This approach, rooted in the so-called “4% rule” from historical market studies, has guided millions of retirees. It assumes a balanced portfolio—typically 60% stocks and 40% bonds—will generate enough growth to offset withdrawals while preserving capital over a 30-year horizon. While this model works under ideal conditions, it falters when real-world disruptions occur, particularly health-related expenses that increase spending unpredictably.

One of the key weaknesses of traditional planning is its reliance on stable market conditions and consistent spending patterns. When a retiree faces a sudden need for long-term care, the required cash flow can double or triple overnight. To meet this demand, many are forced to sell investments at inopportune times—often during market downturns. Selling assets after a market decline locks in losses, reducing the portfolio’s ability to recover when markets rebound. For example, a retiree who sells $80,000 worth of equities after a 20% market drop effectively realizes a $20,000 loss, permanently eroding their financial foundation. Over time, this sequence of poor timing can dramatically shorten the lifespan of a portfolio, even if long-term market averages remain favorable.

Another limitation lies in asset allocation strategy. Most retirement portfolios are designed with broad risk categories—aggressive, moderate, conservative—based on age or time horizon. However, these models rarely account for liquidity needs tied to specific life events. A portfolio may be well-diversified across sectors and geographies, but if its assets are locked in long-term investments, accessing cash without penalties or losses becomes difficult. This mismatch between investment structure and real-life cash flow demands exposes a critical flaw: traditional planning emphasizes growth and income but underestimates the importance of timing and access.

Additionally, the 4% rule assumes a fixed withdrawal rate, but long-term care expenses are anything but fixed. A retiree may spend $50,000 one year on housing and groceries, then face a $100,000 bill the next for assisted living. Without a mechanism to absorb such variability, retirees must either disrupt their withdrawal strategy or rely on family support. This lack of flexibility undermines the stability the model promises. The result is a planning gap—not in knowledge, but in adaptability. Retirement isn’t a static event; it’s a dynamic phase of life that requires a financial strategy capable of evolving with changing needs.

Rethinking Investment Strategy: From Timing the Market to Mastering Rhythm

Given the limitations of traditional planning, a new approach is needed—one that prioritizes resilience over returns and adaptability over rigid rules. This approach is what I call investment rhythm: a strategy that aligns portfolio behavior with the predictable stages and potential disruptions of retirement. Rather than trying to time the market or predict returns, investment rhythm focuses on structuring assets so they provide income, liquidity, and stability when they are most needed. It’s not about beating the market; it’s about staying in sync with life’s natural progression.

At its core, investment rhythm recognizes that retirement unfolds in phases, each with distinct financial needs. The early years may emphasize growth and inflation protection, the middle phase shifts toward income and preservation, and the later years prioritize accessibility and risk mitigation. A rhythmic strategy maps investments to these stages, ensuring that assets mature or generate cash flow in alignment with anticipated needs. For example, instead of holding all bonds to maturity at once, a retiree might use a laddered approach, with bonds maturing annually over a 10-year period. This creates a predictable stream of principal return, reducing reliance on market-dependent withdrawals.

Another key element is psychological readiness. Market volatility is inevitable, but panic-driven decisions are not. A rhythmic strategy includes pre-defined rules for withdrawals, rebalancing, and emergency access, reducing the emotional burden of financial decisions during stressful times. For instance, a retiree might establish a rule to never sell equities to cover care costs unless a dedicated liquidity buffer is exhausted. This rule, documented in advance, serves as a behavioral anchor, preventing reactive choices that could harm long-term outcomes.

Investment rhythm also incorporates hybrid solutions that bridge the gap between insurance and self-funding. Long-term care riders attached to life insurance policies, for example, allow policyholders to access death benefits to pay for care if needed. While not a complete solution, these riders provide a layer of flexibility, enabling retirees to preserve investment assets while covering unexpected costs. The goal is not to eliminate risk—this is impossible—but to create a system that absorbs shocks without collapsing. Like a well-tuned engine, a rhythmic portfolio doesn’t need to be the fastest; it just needs to run smoothly under varying conditions.

Building Your Financial Shock Absorbers: The Liquidity Layer

One of the most effective tools in the rhythmic strategy is the liquidity layer—a dedicated reserve of cash and near-cash assets designed to cover unexpected expenses, particularly long-term care. This buffer typically holds enough to fund 3 to 5 years of potential care costs, depending on individual health, family history, and risk tolerance. Its purpose is not to generate high returns but to provide stability, ensuring that retirees don’t have to sell investments at a loss during market downturns or periods of high need.

Funding this layer requires intentional planning. It should not be an afterthought or a random accumulation of leftover cash. Instead, it should be built systematically during the accumulation phase or early retirement through disciplined rebalancing. For example, as a portfolio grows, excess gains from equities can be shifted into low-volatility instruments like short-term bonds, certificates of deposit, or money market funds. These assets offer modest returns but high reliability, preserving capital while remaining accessible. The key is to treat this layer as a structural component of the portfolio, not an idle account.

One effective method for constructing the liquidity layer is bond laddering. This involves purchasing bonds with staggered maturities—say, one bond maturing each year for the next five years. As each bond matures, the principal is available for use, whether for living expenses or unexpected care costs. This approach provides predictable cash flow without requiring asset sales in volatile markets. It also allows retirees to benefit from higher yields on longer-term bonds while maintaining access to funds. If care is not needed, the matured bonds can be reinvested or used to replenish the layer.

The liquidity layer also serves as a psychological safeguard. Knowing that a reserve exists for emergencies reduces anxiety and prevents rash decisions. During the 2008 financial crisis, for example, retirees without such a buffer were more likely to sell equities at market lows to cover expenses, permanently damaging their portfolios. Those with cash reserves were able to wait out the downturn, allowing their investments to recover. In the context of long-term care, this buffer provides the same advantage: the freedom to act deliberately rather than reactively. It transforms financial stress into strategic choice.

Aligning Asset Types with Life Phases: The Rhythmic Allocation Model

The rhythmic allocation model goes beyond traditional asset allocation by assigning investments not just based on risk, but on timing and purpose. Instead of a one-size-fits-all portfolio, it divides assets into functional categories tied to life stages and anticipated needs. This creates a more dynamic and responsive structure, capable of adapting to changing circumstances without abandoning long-term goals.

In the early retirement phase, typically ages 65 to 75, the focus is on growth and inflation protection. Assets in this stage may include dividend-paying stocks, real estate investment trusts (REITs), and moderate-duration bonds. These investments generate income while maintaining exposure to market appreciation, helping the portfolio keep pace with rising costs. Because health is generally better during these years, the risk of major care expenses is lower, allowing for a slightly higher equity allocation.

The mid-phase, roughly ages 75 to 85, shifts toward preservation and income stability. As the likelihood of needing care increases, the portfolio should begin to reduce exposure to volatile assets. This is where the liquidity layer becomes critical, absorbing potential shocks. Investments may include high-quality corporate bonds, municipal bonds, and fixed annuities that provide guaranteed income. Dividend stocks may still be held, but with a focus on companies with strong balance sheets and consistent payout histories. The goal is not high growth, but reliable cash flow and capital protection.

In the later phase, beyond age 85, accessibility and simplicity become paramount. At this stage, the portfolio should be structured for ease of management, both for the retiree and any family members involved. Assets may include short-term instruments, immediate annuities, and accounts with designated beneficiaries to avoid probate. Long-term care riders or hybrid insurance products can also play a role, providing a source of funds specifically for care without disrupting the core portfolio. The emphasis is on minimizing complexity and maximizing control, ensuring that financial decisions remain clear and executable even under stress.

This phased approach does not follow a rigid calendar but is guided by health, family history, and personal risk tolerance. Some may begin shifting earlier due to chronic conditions, while others may delay based on strong health. The key is to have a framework that allows for intentional transitions, rather than abrupt reactions. By aligning asset types with life phases, retirees gain a clearer picture of how their money supports their life—and how to protect it when needs change.

Avoiding the Emotional Traps: Discipline Over Reaction

Perhaps the greatest challenge in retirement is not market performance, but human behavior. When health declines and care becomes necessary, financial decisions are often made under emotional strain. Fear, guilt, and urgency can lead to impulsive actions—selling investments too quickly, overestimating costs, or abandoning a well-structured plan altogether. These emotional traps can do more damage than market downturns, eroding both wealth and confidence.

One common pitfall is the tendency to view all expenses as equally urgent. A retiree facing a $6,000 monthly care bill may feel compelled to liquidate stocks immediately, even if a liquidity buffer exists. Without clear rules, it’s easy to act on impulse. To counter this, a rhythmic strategy includes pre-written guidelines for withdrawals and asset access. For example, a retiree might specify that care costs will first be covered by the liquidity layer, then by insurance benefits, and only as a last resort by selling equities. Documenting these rules in advance removes the burden of decision-making during crisis.

Another emotional challenge is the fear of running out of money. This anxiety can lead to excessive conservatism—holding too much cash or avoiding necessary care to save costs. While prudence is important, over-caution can reduce quality of life and lead to worse health outcomes. A balanced approach acknowledges risk without surrendering to it. Regular reviews with a trusted advisor, clear communication with family, and a written financial plan can all help maintain perspective and discipline.

Family dynamics also play a role. Adult children may pressure parents to preserve assets for inheritance, or conversely, urge them to spend freely. These tensions can cloud judgment. Establishing open conversations about financial goals, care preferences, and legacy intentions helps align expectations and reduce conflict. A family meeting with a financial professional present can provide neutral guidance and reinforce the importance of the retirement plan’s integrity.

Ultimately, the success of an investment rhythm depends not on perfect conditions, but on consistent behavior. Markets will fluctuate, health will change, and costs will rise. But with preparation, structure, and emotional discipline, retirees can navigate these challenges with confidence. The rhythm isn’t about avoiding risk—it’s about moving through it with purpose.

Putting It All Together: A Sustainable Path Forward

Retirement is not a static destination but a journey marked by evolving needs, changing health, and unforeseen challenges. The traditional model of saving, investing, and withdrawing has served many well, but it often fails when life deviates from the script. The rise of long-term care costs—a predictable yet frequently ignored reality—exposes the limitations of rigid plans and highlights the need for a more adaptive approach.

The investment rhythm strategy offers a sustainable alternative. By focusing on alignment, liquidity, and behavioral discipline, it creates a financial structure capable of absorbing shocks without losing direction. It replaces the illusion of control with the reality of preparedness. Instead of chasing high returns or fearing market drops, retirees learn to move in sync with life’s natural phases, adjusting their portfolio’s tempo as needs change.

This approach does not promise wealth maximization or risk elimination. What it offers is something more valuable: financial peace. It means knowing that a care expense, while significant, will not derail decades of planning. It means having the freedom to make thoughtful decisions, not desperate ones. It means protecting not just assets, but dignity, independence, and family harmony.

Building this rhythm requires intention, but not perfection. Start by assessing your current portfolio through the lens of liquidity and timing. Evaluate your exposure to long-term care risk and consider how a dedicated buffer might change your choices. Review your asset allocation not just by risk level, but by life phase and purpose. Talk to your family and advisor about your goals and fears. Small, deliberate steps today can create lasting resilience tomorrow.

In the end, the goal of retirement planning is not to achieve the highest portfolio balance, but to live with confidence and control. By shifting from static rules to dynamic rhythm, retirees gain the tools to face the future—not with fear, but with readiness. Because the true measure of financial success isn’t how much you earn, but how well you endure.