How I Sliced My Stock Taxes Without Selling a Single Share

You work hard for your money—why let taxes eat half your gains? I learned this the hard way after a big stock win left me with a shocking tax bill. That’s when I dug deep into smarter ways to keep more of what I earned. This isn’t about shady loopholes or risky moves—it’s real, legal, and surprisingly simple. In this article, I’ll walk you through how smart tax planning can protect your stock profits, reduce your burden, and help you build wealth without fear of the taxman knocking. What started as a personal frustration turned into a powerful shift in how I manage my investments. And the best part? None of these strategies required selling a single share or taking on extra risk. Instead, it was about understanding the rules, using structure wisely, and making small changes that add up to big savings over time.

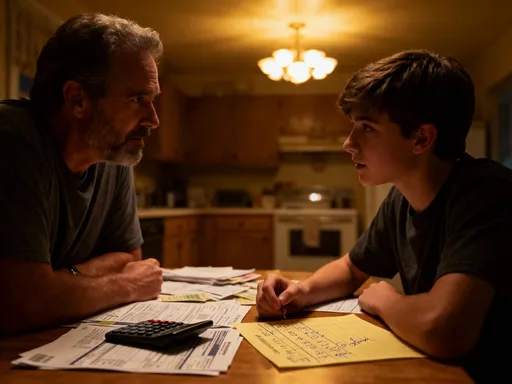

The Wake-Up Call: When My Stock Gains Came With a Price Tag

For years, I celebrated every stock that doubled or tripled in value. I tracked my portfolio like a scoreboard, proud of each winning trade. But one spring, after selling a few fast-growing tech stocks I’d held for just ten months, I received a tax notice that felt like a gut punch. My $45,000 profit had triggered nearly $13,000 in taxes—almost 30% of my gain. That number stunned me. I had assumed capital gains were taxed at a reasonable rate, but I didn’t realize the full weight of short-term capital gains treatment.

Here’s what I learned: in many countries, including the United States, profits from stocks held for one year or less are considered short-term capital gains. These gains are taxed at the same rate as ordinary income—meaning they’re subject to your regular income tax bracket. For someone earning even a moderate salary, that could mean rates of 22%, 24%, or higher. In contrast, long-term capital gains—on assets held more than a year—benefit from lower tax rates, often 0%, 15%, or 20%, depending on income level. That difference isn’t small. It can mean thousands of dollars saved on a single transaction.

My mistake wasn’t in picking the stock—it was in timing. I sold too soon, eager to lock in profits, but unaware that waiting just a few more weeks would have qualified me for the lower long-term rate. That experience was my wake-up call. I realized that investing isn’t just about picking winners—it’s about keeping them long enough to be rewarded fully. Ignorance of tax rules had cost me a vacation’s worth of savings. From that point on, I made it a rule: never sell based on emotion or impulse. Every exit decision would now include a tax check-up. That shift alone began to reshape how I approached the market.

Tax Drag: The Silent Killer of Long-Term Wealth

Most investors focus on returns—how much their portfolio grows each year. But there’s another number that matters just as much: how much of that growth they actually get to keep. That’s where tax drag comes in. Tax drag refers to the erosion of investment returns caused by taxes paid on gains, dividends, or interest. It doesn’t show up as a single dramatic loss. Instead, it acts slowly, like a steady drip draining water from a bucket. Over time, that drip becomes a flood.

Imagine two investors, both starting with $100,000 and earning 7% annual returns before taxes. One invests in a tax-efficient way, deferring gains and minimizing taxable distributions. The other frequently trades, realizes gains every year, and pays taxes annually at a 20% rate. After 20 years, the tax-efficient investor ends up with over $300,000. The high-turnover investor? Just under $250,000. That’s a difference of more than $50,000—not because of performance, but because of tax timing.

The compounding effect works both ways. When you pay taxes early, you lose the opportunity for those tax dollars to grow alongside your investments. Every dollar sent to the government is a dollar that can’t compound. This is especially true in taxable brokerage accounts, where every dividend, every interest payment, and every realized gain is potentially taxable in the year it occurs. Over decades, this drag can reduce total wealth by 20%, 30%, or even more, depending on the strategy and tax rate.

Recognizing tax drag changed how I measure success. Now, I don’t just ask, “Did this investment go up?” I also ask, “How much of that gain am I keeping?” I began tracking my portfolio’s tax efficiency—how much turnover it generates, how many gains I realize annually, and how much income is taxable. I discovered that even small adjustments, like holding a stock a few months longer or choosing a more tax-friendly fund, could significantly reduce my tax drag. It wasn’t about chasing higher returns—it was about preserving more of what I already had.

Holding Power: Why Time Is Your Tax Advantage

One of the most powerful tax tools available to investors doesn’t require complex software, expensive advisors, or offshore accounts. It’s simply time. Holding a stock for more than one year unlocks preferential tax treatment in many jurisdictions. In the U.S., for example, long-term capital gains rates are significantly lower than short-term rates for most taxpayers. For someone in the 22% income tax bracket, the difference between a 22% tax on short-term gains and a 15% tax on long-term gains can be substantial—especially on larger positions.

I began restructuring my investment timeline around this principle. Instead of selling a stock as soon as it hit my price target, I started asking, “Is it worth waiting a few more weeks to qualify for long-term treatment?” In several cases, the answer was yes. One memorable example involved a biotech stock that surged 80% in nine months. My instinct was to sell and lock in the gain. But I paused. I checked the calendar. The one-year mark was just seven weeks away. I decided to wait. That decision saved me over $1,800 in taxes on a $12,000 gain. The stock didn’t drop—it kept rising. I got both the lower tax rate and an additional 12% gain.

This strategy doesn’t mean holding forever or ignoring risks. It means being intentional about timing. I now track the purchase date of every stock in my portfolio. I set calendar reminders for positions approaching the one-year mark. If a stock is near my target price but hasn’t hit the long-term threshold, I evaluate whether the extra wait is worth the tax savings. Often, it is. The market rarely moves in straight lines. A few weeks’ patience can mean the difference between a high tax bill and a much lighter one.

Moreover, this approach encourages discipline. It forces me to think beyond short-term price movements and focus on long-term value. It reduces impulsive selling and helps me stay aligned with my original investment thesis. Over time, this simple habit—waiting for the long-term clock to tick—has saved me thousands of dollars. It’s not flashy, but it’s effective. Time, it turns out, isn’t just on your side—it’s one of your best tax allies.

Tax-Loss Harvesting: Turning Losing Trades Into Real Savings

No investor wins on every trade. Losses are inevitable. But what if those losses could actually help you? That’s the idea behind tax-loss harvesting—a strategy that allows investors to use losing positions to offset taxable gains. I used to hold onto losing stocks, hoping they’d bounce back. I didn’t want to “lock in” the loss. But I learned that selling a loser isn’t admitting defeat—it’s a smart financial move when done strategically.

Here’s how it works: when you sell a stock at a loss, that loss can be used to offset capital gains from other investments. If your losses exceed your gains, you can deduct up to $3,000 from your ordinary income each year. Any remaining losses can be carried forward to future years. This means a losing trade isn’t just a setback—it’s a potential tax asset.

I began applying this to my portfolio. When a stock I owned dropped 20% and showed no signs of recovery, I didn’t ignore it. I evaluated whether it still fit my long-term plan. If not, I sold it and immediately reinvested the proceeds in a similar—but not identical—stock. This allowed me to maintain market exposure while locking in the tax loss. For example, I sold a struggling renewable energy stock and bought another in the same sector with stronger fundamentals. The position stayed aligned with my strategy, but now I had a $4,200 loss to use against gains elsewhere.

The key is avoiding the wash-sale rule. In the U.S., if you sell a stock at a loss and buy a “substantially identical” security within 30 days before or after, the loss is disallowed for tax purposes. I make sure to either wait 31 days or choose a different company or fund that serves a similar role in my portfolio. This way, I keep the tax benefit without violating the rules.

Tax-loss harvesting doesn’t make the market kinder. But it does make losses less painful. It turns a negative into a planning opportunity. Over the past five years, this strategy has reduced my tax bill by an average of $2,500 annually. It’s not about chasing losses—it’s about using them wisely. And it’s one of the few ways you can actually benefit from a down market.

Account Stacking: Putting the Right Stocks in the Right Accounts

Not all investment accounts are created equal. A stock held in a regular brokerage account is taxed differently than the same stock held in a retirement account. This simple fact changed how I structure my entire portfolio. I used to keep all my investments in one taxable brokerage account for simplicity. But I realized I was leaving money on the table—unnecessarily paying taxes on gains and dividends that could have been deferred or avoided altogether.

Now, I practice what financial planners call “account stacking” or “asset location”—placing different types of investments in the accounts where they’re taxed most efficiently. The goal is to minimize taxes by matching each asset class with the most tax-advantaged home.

For example, I now hold high-growth stocks—those likely to appreciate significantly—in my taxable brokerage account. Why? Because when I eventually sell them after more than a year, I’ll pay the lower long-term capital gains rate. Even better, I won’t owe taxes until I sell, allowing the gains to compound tax-free in the meantime. Meanwhile, I keep bonds and real estate investment trusts (REITs) in my tax-deferred IRA. These assets generate regular taxable income—interest and dividends—that would be taxed annually in a regular account. By holding them in an IRA, I defer all taxes until withdrawal, letting the income compound over time.

I also use my Roth IRA for assets I expect to grow the most over decades, like emerging market funds or individual tech stocks. Since qualified withdrawals from a Roth are completely tax-free, this means all future gains—and their compounding—will never be taxed. It’s like planting a money tree in a tax-free greenhouse.

This strategy doesn’t increase risk or require more trading. It’s just smarter placement. By aligning each investment with the right account type, I’ve reduced my annual tax bill and improved my after-tax returns. It’s one of the most effective things I’ve done—and it cost me nothing to implement.

Dividend Whispering: Managing Income Without the Tax Bite

For years, I loved dividend stocks. They felt like free money—cash payments just for holding shares. But then I got my tax statement and saw that those “free” dividends had triggered a $1,400 tax bill. I had no idea that dividends were taxable. Worse, I learned that not all dividends are taxed the same. Non-qualified dividends are taxed at ordinary income rates, while qualified dividends—those from U.S. corporations held long enough—benefit from lower capital gains rates.

This changed how I approach income investing. I now separate dividend payers into two categories: those with qualified dividends and those without. I prioritize stocks that pay qualified dividends and hold them in my taxable account, where the lower tax rate applies. But I don’t hold high-yield, non-qualified dividend stocks—like some master limited partnerships (MLPs) or foreign stocks—in that account. Instead, I place them in my IRA, where the income grows tax-deferred and won’t trigger an annual tax bill.

I also pay attention to reinvested dividends. Many investors use dividend reinvestment plans (DRIPs) to automatically buy more shares. That’s smart for compounding—but it doesn’t make the dividends tax-free. Even if you don’t take the cash, you still owe taxes on it. I now track every reinvested dividend as taxable income, just as if I’d received it in cash.

Timing matters, too. If I’m close to the one-year mark on a dividend stock, I might delay selling a few days to ensure the dividend qualifies for the lower rate. I also avoid buying dividend stocks just before they pay out, unless I’m prepared to pay the tax. This “dividend capture” strategy can backfire if the tax cost outweighs the benefit.

Managing dividends isn’t about avoiding income—it’s about receiving it in the most tax-efficient way. By being intentional about which stocks pay dividends, where I hold them, and when I realize gains, I’ve turned a former tax surprise into a controlled part of my strategy. The income still flows, but now it flows smarter.

The Big Picture: Building a Tax-Aware Investment Mindset

Tax efficiency isn’t a one-time fix or a secret trick. It’s a mindset—a way of thinking about every financial decision through the lens of what you keep, not just what you make. Since adopting this approach, I’ve transformed my relationship with investing. I no longer see taxes as an unavoidable enemy. Instead, I see them as a variable I can manage—like fees, risk, or diversification.

Every time I consider buying a stock, I ask: Where will I hold it? What kind of income will it generate? How long should I plan to keep it? When I think about selling, I check the holding period, the gain amount, and the tax implications. I don’t let taxes drive every decision, but I make sure they’re part of the conversation.

This shift didn’t require drastic changes. I didn’t hire a financial advisor or switch brokerages. I didn’t stop investing or take on riskier positions. I simply became more informed and more intentional. I learned the rules, used the tools available to me, and made small, consistent adjustments. Over time, those adjustments compounded—just like my investments.

Today, my portfolio is more tax-efficient than ever. I realize fewer short-term gains, harvest losses when appropriate, stack assets by account type, and manage dividends with care. The result? I keep more of what I earn. My wealth grows faster, not because I’m making higher returns, but because less of it is lost to taxes.

The goal isn’t to avoid taxes—that would be neither legal nor ethical. The goal is to respect them, understand them, and work within the system to build lasting wealth. Because in the end, financial success isn’t measured by how much you make. It’s measured by how much you keep, how long it lasts, and what it allows you to do. And when you cut your tax bill the smart way, you’re not just saving money—you’re building a more secure, more resilient financial future.