How I Tackled High School Costs Without Losing Sleep

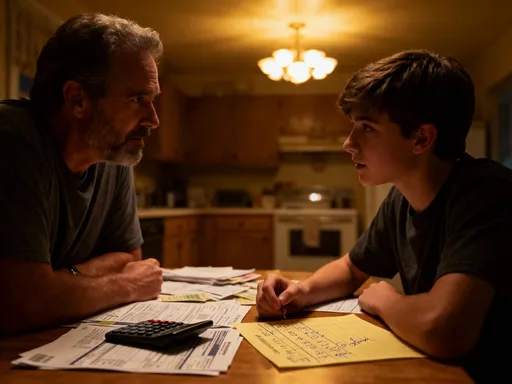

Paying for high school shouldn’t feel like a financial death sentence. I’ve been there—staring at bills, stressing over extracurricular fees, and wondering how to save without sacrificing quality. The truth? With smart planning, it’s possible to stay ahead. This is not about cutting corners blindly, but building a realistic strategy that works. Let me walk you through what actually helped my family stay on track—without the panic. It wasn’t about earning more or living frugally to the point of deprivation. It was about clarity, consistency, and calm decision-making. And the peace that came from knowing we were prepared—that was priceless.

The Hidden Price of High School Education

Public high school tuition may be covered by tax dollars, but the full cost of a high school education extends far beyond the classroom. Many families operate under the misconception that once their child enrolls in a public school, major expenses end there. In reality, a growing number of fees and indirect costs quietly accumulate each year, creating financial pressure that can strain even stable household budgets. These expenses are not outliers; they are now woven into the fabric of the standard academic experience, making them nearly unavoidable for students aiming to participate fully.

Consider the typical high school student’s annual expenses: lab fees for science courses, charges for Advanced Placement (AP) exams, yearbook purchases, class trips, sports team uniforms, instrument rentals for band, and mandatory technology such as laptops or tablets. Add to that the social expectations surrounding prom, homecoming, and senior portraits—events that, while not academic, are deeply embedded in the high school journey. For families with more than one child in school, these costs multiply quickly. A single AP exam can cost over $100, and a complete senior year experience, including cap and gown, graduation announcements, and prom tickets, can exceed $1,000 when transportation, attire, and dinners are factored in.

What makes these expenses particularly challenging is their unpredictability. Schools may announce new fees mid-year, or a student may decide to join a club or sport that requires upfront payments. Unlike college, where financial aid and tuition breakdowns are more transparent, high school cost structures are often decentralized and inconsistently communicated. This lack of clarity can leave parents scrambling, especially if they haven’t built a financial cushion. The burden is not evenly distributed; higher-income families may absorb these costs without much thought, while others must make difficult trade-offs between participation and financial stability.

The psychological toll of this uncertainty should not be underestimated. When families feel they must choose between their child’s social integration and their monthly budget, stress levels rise. Children may sense this tension, leading to anxiety or reluctance to ask for what they need. The solution begins with recognition: these costs are real, recurring, and must be planned for. Ignoring them is not frugality—it’s financial denial. By mapping out these hidden expenses early, families can shift from reactive spending to proactive budgeting, reducing both financial strain and emotional burden.

Why Financial Planning Starts Earlier Than You Think

Many parents assume that financial planning for high school begins in ninth grade, or at the earliest, during the eighth-grade transition. However, waiting until high school starts is like beginning a savings plan the week before a major purchase—the window for meaningful preparation has already closed. Real financial readiness begins much earlier, often in upper elementary or middle school, when patterns of academic engagement, extracurricular interest, and educational trajectory begin to emerge. These early years are not just developmental; they are financial groundwork.

Consider a student who shows interest in music or robotics. By sixth or seventh grade, they may need instruments, competition fees, or specialized software. If the family waits until high school to fund these interests, they’ll face sudden, concentrated costs. But if they start setting aside even $25 a month in a dedicated account, compound interest and consistent contributions can significantly reduce the burden years later. The same principle applies to academic preparation. Students aiming for AP courses, honors programs, or private school transfers often need tutoring, test prep, or application fees—all of which are easier to manage with advance planning.

Another critical factor is the rising cost of educational technology. Most high schools now require students to have access to laptops, reliable internet, and digital tools. Some schools provide devices, but many expect families to supply their own, often recommending specific models that can cost $500 or more. If parents wait until ninth grade to address this, they may be forced to make a large, unplanned purchase. But families who anticipate this need can save gradually, buy secondhand when appropriate, or take advantage of back-to-school sales without financial strain.

Starting early also allows for flexibility. If a child changes interests or academic paths, the family has time to adjust their savings goals without panic. It creates breathing room for exploration, rather than forcing choices based on immediate affordability. Most importantly, early planning fosters a mindset of intentionality. Instead of reacting to each new fee with stress, families learn to expect and prepare for them. This shift from crisis management to strategic foresight is one of the most powerful tools in financial wellness. The earlier it begins, the more natural it becomes.

Mapping Out Your Family’s Education Spending Blueprint

Every family’s financial situation is unique, which means a generic budget template won’t capture the full picture of high school expenses. What works for one household may fail another. The most effective approach is to create a personalized education spending blueprint—a dynamic, living document that outlines all anticipated costs, funding sources, and timelines. This isn’t a one-time exercise; it’s an annual practice that evolves as children grow and school requirements change.

The first step is comprehensive cost identification. Begin by listing every potential expense across four categories: academic, technological, transportation, and social. Under academic, include fees for AP exams, lab supplies, textbooks, yearbooks, and field trips. Under technological, list laptops, software subscriptions, internet access, and printer supplies. Transportation may involve parking permits, bus passes, or fuel costs for driving to after-school activities. Social expenses cover prom, homecoming, senior portraits, graduation announcements, and club dues. Be thorough—even small recurring costs add up over time.

Once the list is complete, categorize each item by urgency and flexibility. Fixed costs—like required exam fees or mandatory technology—must be funded regardless of budget constraints. Flexible costs, such as optional trips or premium clothing for events, can be adjusted or eliminated if needed. Assign each item a projected cost and a timeline. For example, AP exam fees are typically due in the fall, while prom expenses peak in the spring. This timeline helps sequence savings and avoid last-minute scrambles.

Next, identify funding sources. Will costs be covered through general household income, a dedicated savings account, student earnings, or financial aid? Some families use a 529 plan or a custodial account specifically for education-related expenses. Others set up automatic monthly transfers to a separate bank account labeled “High School Fund.” The key is to match each expense with a clear funding path. This eliminates the habit of paying from a general checking account, where expenses can blur and overspending occurs unnoticed.

Revisit the blueprint at least twice a year—once at the start of the school year and again in the spring. Compare actual spending to projections, adjust for new fees, and update savings goals. This ongoing review turns budgeting from a chore into a strategic tool. It also provides transparency for the entire family, helping teens understand the value of money and the cost of participation. Over time, this blueprint becomes more accurate and easier to maintain, reducing stress and increasing confidence in financial decisions.

Smart Savings Strategies That Actually Work

Saving for high school expenses doesn’t require a six-figure income or drastic lifestyle changes. What it does require is consistency, discipline, and a few practical strategies that turn small actions into meaningful results. The most effective savings methods are those that operate quietly in the background, making them sustainable over time. These are not get-rich-quick schemes or extreme frugality tactics—they are proven, low-effort approaches that build financial resilience.

One of the most powerful tools is automatic savings. Setting up a recurring transfer from a checking account to a dedicated education fund ensures that saving happens before spending. Even $50 a month adds up to $600 a year—enough to cover several AP exams or a laptop over time. The psychological benefit is just as important: when savings are automatic, they don’t feel like a sacrifice. They become a normal part of the financial routine, like paying a utility bill.

Another effective strategy is redirecting windfalls. Tax refunds, holiday bonuses, cash gifts, or even small inheritances are often spent impulsively on short-term wants. But when directed into an education fund, they can make a significant dent in long-term costs. For example, a $3,000 tax refund invested early in a student’s middle school years could grow substantially with compound interest or be used to cover senior year expenses without debt. The key is to decide in advance where these funds will go, before they enter the household budget.

Micro-savings apps offer another modern solution. These tools link to a checking account and automatically round up everyday purchases to the nearest dollar, transferring the difference into a savings pool. A $4.25 coffee becomes a $0.75 deposit; over time, these small amounts accumulate. Some apps even invest the savings in low-risk funds, allowing for modest growth. While not a primary savings vehicle, micro-saving can supplement other efforts and help families reach specific goals, like funding a class trip or sports equipment.

Finally, consider adjusting spending habits without sacrificing quality. Families can save by buying gently used laptops, sharing instruments among siblings, or choosing budget-friendly alternatives for events. For example, renting a prom dress instead of buying one can save hundreds. These choices aren’t about deprivation—they’re about intentionality. When savings become a quiet, consistent practice, they stop feeling like a burden and start feeling like progress.

Earning and Funding: Creative Ways to Offset Costs

While saving is essential, there are times when additional income is needed to keep up with rising education costs. Relying solely on parental income can create strain, especially when unexpected fees arise. Supplemental funding doesn’t have to mean taking on a second job or going into debt. There are creative, ethical, and practical ways for families and students to generate extra income that also build responsibility and skills.

For teenagers, part-time work can be a valuable source of funding and personal growth. Jobs in retail, food service, tutoring, or lawn care allow students to earn money while developing time management and work ethic. Even 10 to 15 hours a week at minimum wage can generate hundreds of dollars per semester—enough to cover personal expenses like phone bills, gas, or extracurricular fees. Parents can encourage this by framing work not as a burden, but as a way to gain independence and contribute to family goals.

Freelance opportunities are another growing option. Talented students can offer services like graphic design, video editing, music lessons, or academic coaching through online platforms. These gigs often pay more than traditional jobs and can be scheduled around schoolwork. Paid internships, while competitive, provide both income and resume-building experience, especially in fields like STEM, arts, or business. Some schools even partner with local organizations to create youth employment programs, making it easier for students to find opportunities.

Families can also explore passive or shared-income strategies. Hosting an international exchange student through a reputable program often includes a stipend that can offset household expenses. Renting out a basement apartment or unused room on a short-term basis can generate extra cash, though this requires careful consideration of privacy and safety. Garage sales, selling unused electronics, or participating in buy-sell-trade groups are low-effort ways to turn clutter into capital.

Schools themselves may offer financial assistance. Need-based fee waivers for AP exams, SAT/ACT testing, or extracurricular activities are available in many districts, though not all families know to apply. Early payment discounts for trips or materials can also reduce costs. The rule of thumb is simple: always ask. Even partial reductions can free up funds for other priorities. The goal is not to shift all financial responsibility to the student, but to create a team effort where everyone contributes according to their ability. This shared approach builds unity, reduces pressure, and teaches financial cooperation.

Avoiding Common Financial Traps Parents Fall Into

Even well-meaning parents can make financial missteps when managing high school costs. These mistakes are not due to lack of care, but often stem from emotional pressure, social comparison, or lack of awareness. Recognizing these common traps is the first step toward avoiding them. With foresight, families can protect their financial health and make decisions that align with long-term stability rather than short-term emotions.

One of the most dangerous traps is relying on credit cards to cover school-related expenses. When cash flow is tight, it’s tempting to swipe a card for a $150 exam fee or a $200 prom dress. But unless the balance is paid in full immediately, these purchases accrue interest, turning small costs into long-term debt. High-interest credit card debt can linger for years, far outlasting the memory of the event it funded. A better approach is to save in advance or explore payment plans offered by schools or vendors that don’t charge interest.

Another common mistake is overspending on items labeled as “essential” that aren’t truly necessary. The latest laptop model, premium study guides, or designer athletic gear may seem important, but they often offer minimal benefit over more affordable alternatives. Comparing your child’s needs to what other families are buying can fuel unnecessary spending. The truth is, most schools don’t require luxury items—they require functionality. A gently used laptop or shared textbook can serve just as well.

Ignoring inflation in education costs is another subtle but serious error. Many parents budget based on last year’s fees, not realizing that costs rise annually. AP exam fees, for example, have increased steadily over the past decade. Field trip costs, technology requirements, and even yearbook prices often go up. Failing to account for this inflation leads to under-saving and last-minute stress. A prudent approach is to build a 3% annual increase into the education budget, aligning with historical trends in education spending.

Finally, avoiding open conversations about money can backfire. When parents shield children from financial realities, teens may develop unrealistic expectations or feel guilty for asking for help. Transparency, when handled with care, fosters understanding and responsibility. Discussing budget limits, trade-offs, and savings goals helps teens appreciate the value of money and make thoughtful choices. Avoiding these traps isn’t about cutting corners—it’s about making smarter, more sustainable decisions.

Building Financial Awareness in Teens: A Lasting Investment

One of the most valuable outcomes of high school financial planning is not just covering expenses—it’s teaching teens how money works. Involving adolescents in budget discussions, savings goals, and spending decisions equips them with practical skills that will serve them long after graduation. This isn’t about burdening them with adult responsibilities; it’s about preparing them for independence in a world where financial literacy is essential.

When teens understand where money goes, they make more thoughtful choices. A student who knows the cost of an AP exam is $125 may think twice before signing up for multiple tests without a plan. One who helps research affordable laptop options learns comparison shopping and delayed gratification. These experiences build financial confidence and reduce impulsive spending later in life. Studies show that young adults who were involved in family budgeting are more likely to save regularly, avoid debt, and feel in control of their finances.

Parents can start by including teens in annual budget reviews. Walk them through the education spending blueprint, explain funding sources, and discuss trade-offs. Encourage them to set personal savings goals—for a phone, a car, or a trip—and help them create a plan. Apps that track spending or simulate budgeting can make learning interactive and engaging. Some families even give teens a fixed monthly allowance for discretionary spending, teaching them to manage limited resources.

Transparency also reduces family tension. When teens understand why certain purchases are approved or denied, they’re less likely to feel deprived or resentful. Instead, they learn that money is a tool to be managed, not a source of conflict. This openness fosters trust and maturity, turning financial planning from a parental duty into a shared family practice. The lessons learned during these years—budgeting, saving, earning, and prioritizing—are not just about high school. They are the foundation of lifelong financial well-being.

The real return on this effort isn’t just a balanced budget or a debt-free senior year. It’s a young adult who knows how to plan, adapt, and make informed choices. That kind of confidence can’t be bought—it’s earned through experience. And that, more than any diploma, is a true measure of success.

Conclusion

Planning for high school expenses isn’t about achieving perfection—it’s about making consistent progress. There is no single right way to manage these costs, but there are proven strategies that reduce stress and increase control. By starting early, staying aware of both visible and hidden expenses, and involving the whole family in the process, parents can transform uncertainty into confidence. The goal isn’t to eliminate every financial challenge, but to approach them with preparation and clarity.

Smart financial planning turns reactive panic into proactive strategy. It allows families to support their children’s education and extracurricular involvement without compromising long-term stability. The methods discussed—from building a personalized spending blueprint to using automatic savings and fostering teen financial literacy—are not complex, but they are powerful when applied consistently. They work not because they promise instant results, but because they build habits that last.

Ultimately, the greatest benefit of this approach extends beyond money. It’s about peace of mind—the quiet assurance that comes from knowing you’re prepared. It’s about strengthening family communication and teaching values that will guide the next generation. And it’s about laying a foundation for what comes after high school: college, careers, and independent living.

The real return on this effort isn’t just financial stability. It’s the confidence that, no matter what costs arise, your family has the tools and the mindset to handle them. That kind of security is worth every thoughtful decision, every saved dollar, and every honest conversation. And that, in the end, is how you tackle high school costs without losing sleep.