Why Upgrading Appliances Is Smarter Than You Think

What if I told you that replacing your old fridge or washer isn’t just about convenience—it’s a financial move? I used to think appliance upgrades were pure expenses, until I saw how they fit into a bigger investment cycle. From cutting monthly bills to boosting home value, these changes can pay off in surprising ways. Let me walk you through the real financial logic behind smart upgrades—no jargon, just practical insights that actually work.

The Hidden Investment in Everyday Appliances

Most people view household appliances as tools for daily living, not financial assets. A refrigerator keeps food cold, a washing machine cleans clothes, and an oven cooks dinner—simple functions, straightforward purposes. Yet when examined through the lens of long-term budgeting and home economics, these appliances take on a new identity: they become active components of a household’s financial ecosystem. Upgrading them is not merely a matter of convenience or aesthetics; it can be a strategic decision that influences cash flow, reduces recurring costs, and even enhances net worth over time.

The idea of an appliance as an investment may seem counterintuitive at first. Unlike stocks or real estate, these items don’t appreciate in market value. However, they do appreciate functionally. Functional appreciation refers to the increasing benefit derived from improved performance, reliability, and efficiency over time. For example, a modern refrigerator with advanced insulation and compressor technology uses significantly less electricity than a unit from 15 years ago. This reduction in energy consumption translates directly into lower utility bills, month after month, year after year. Over a decade, those savings can amount to hundreds—or even thousands—of dollars, effectively offsetting the initial cost of the upgrade.

Additionally, newer appliances typically require less maintenance and are less prone to breakdowns. Older models often need repeated repairs as parts wear out, and each repair adds to the total cost of ownership. At a certain point, the cumulative expense of fixing an aging appliance exceeds the price of replacing it. By upgrading proactively, homeowners avoid this cycle of diminishing returns. They also gain peace of mind knowing their systems are reliable, reducing the stress and disruption associated with unexpected failures. In this way, an appliance upgrade becomes not just a capital expenditure but a calculated investment in stability, efficiency, and long-term savings.

Breaking Down the Upgrade Cycle

Every major household appliance has a predictable lifespan, shaped by design, usage, and environmental factors. Refrigerators typically last 10 to 15 years, washing machines around 10 to 12 years, and HVAC systems between 15 and 20 years. Dishwashers, dryers, and water heaters fall within similar ranges. While some units may continue operating beyond these averages, performance inevitably declines. Efficiency drops, noise increases, and the risk of failure rises sharply after the midpoint of an appliance’s expected life.

Waiting until an appliance fails completely may seem like a way to save money, but in reality, it often leads to higher overall costs. Emergency repairs are usually more expensive than routine service, and replacement under pressure rarely allows for optimal decision-making. Buyers may settle for a lower-quality model or pay a premium for fast delivery and installation. Worse, a sudden breakdown can cause secondary damage—a leaking water heater can lead to flooring or structural issues, while a failing refrigerator might result in spoiled food and wasted groceries. These hidden costs turn what appears to be a delay in spending into a more expensive outcome.

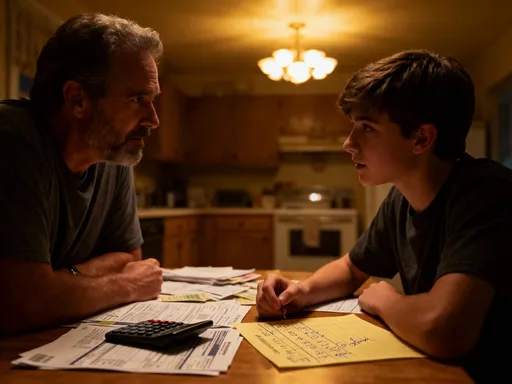

Strategic timing transforms appliance replacement from a reactive chore into a proactive financial strategy. By tracking purchase dates and monitoring signs of aging—such as increased energy bills, unusual noises, or inconsistent performance—homeowners can plan upgrades before failure occurs. This approach allows for research, price comparison, and access to seasonal promotions or rebates. It also enables budgeting over time, spreading the cost through savings or low-interest financing. Families who adopt this mindset shift from crisis-driven spending to controlled, predictable investment cycles that align with their broader financial goals.

Consider the example of a family replacing their 13-year-old washing machine. Rather than waiting for a catastrophic leak, they begin setting aside $50 per month two years in advance. When the time comes, they have $1,200 saved and are ready to purchase a high-efficiency front-load model during a spring sales event. The new machine uses 40% less water and 25% less energy, reducing utility costs immediately. They avoid emergency plumbing bills and gain better cleaning performance. In this scenario, the upgrade is not an expense—it’s a well-timed, cost-effective improvement that delivers lasting value.

Energy Efficiency: The Silent Money Saver

One of the most compelling financial arguments for upgrading appliances lies in energy efficiency. Modern appliances are engineered to meet increasingly strict standards, such as those set by the U.S. Environmental Protection Agency’s Energy Star program. These units use advanced technologies—variable-speed motors, smart sensors, improved insulation, and optimized cycles—to deliver the same or better performance while consuming far less electricity and water.

The difference between older and newer models can be dramatic. A refrigerator manufactured in 2000 might consume around 1,000 kilowatt-hours (kWh) per year, while a current Energy Star-certified model uses as little as 400 kWh annually. At an average electricity rate of $0.13 per kWh, that’s a savings of $78 per year—more than $700 over a decade. Similarly, a new washing machine can reduce water usage by up to 50%, translating into lower water and sewer bills, especially in regions where utility costs are high.

These savings may seem modest when viewed monthly, but they compound over time. Unlike speculative investments, which carry market risk, energy savings are predictable and guaranteed as long as the appliance is used. This makes efficiency-driven upgrades one of the lowest-risk ways to generate a return on household spending. In financial terms, upgrading to an energy-efficient appliance is akin to locking in a fixed-rate return—except instead of earning interest, you’re reducing expenses.

Moreover, reduced energy consumption has secondary benefits. Lower demand on electrical systems can extend the life of home wiring and reduce strain during peak usage periods. In homes with solar panels, efficient appliances maximize the value of generated power, potentially decreasing or eliminating grid reliance. For households aiming to reduce their carbon footprint, the environmental impact is significant, but the financial benefit remains the primary driver for most consumers. When efficiency is factored into the total cost of ownership, the case for upgrading becomes not just logical but financially urgent.

Tax Incentives and Rebates: Free Money on the Table

Many homeowners overlook a powerful tool that can dramatically reduce the net cost of appliance upgrades: government and utility-sponsored incentive programs. Federal tax credits, state rebates, and local utility discounts are frequently available for the purchase of energy-efficient appliances, particularly for major systems like HVAC units, water heaters, and insulation upgrades. These programs exist to encourage sustainable behavior and reduce overall energy demand, but they also serve as direct financial support for consumers making responsible upgrades.

For example, the U.S. federal government has periodically offered tax credits for qualifying energy-efficient home improvements, including high-efficiency heat pumps, water heaters, and insulation. While specific programs change over time, the underlying policy support remains consistent. Additionally, many utility companies provide instant rebates at the point of sale for Energy Star-certified appliances. A homeowner might receive a $75 rebate on a new refrigerator or a $100 discount on a qualifying clothes washer. Some programs even offer higher incentives for low-income households, making upgrades more accessible across income levels.

The impact of these incentives is substantial. A $1,200 refrigerator might effectively cost $1,125 after a rebate, reducing the payback period for energy savings. In some cases, combined federal, state, and local programs can cover a significant portion of the purchase price, especially for high-efficiency models. The key is awareness and timing. These programs are not always widely advertised, and funding is often limited. Consumers who research available incentives before making a purchase can take full advantage of these opportunities.

To access these benefits, homeowners should start by visiting the Database of State Incentives for Renewables & Efficiency (DSIRE), a comprehensive online resource that lists active programs by location. They can also contact their utility provider directly or consult with retailers who participate in rebate programs. Planning upgrades around known promotion periods—such as Earth Day, Energy Awareness Month, or end-of-year sales—can further increase savings. By treating rebates and tax credits as integral parts of the upgrade budget, families turn what seems like a necessary expense into a partially subsidized investment with accelerated returns.

Home Value and Market Readiness

While the day-to-day benefits of appliance upgrades are valuable, their impact extends beyond personal comfort and utility savings. When it comes time to sell a home, modern, well-maintained appliances can significantly influence buyer perception and market value. Real estate agents consistently report that updated kitchens and laundry rooms are among the top features that attract serious buyers, particularly in competitive markets.

Appraisers, too, take appliance condition into account when evaluating a property. While they may not assign a specific dollar value to a new dishwasher, they assess the overall condition and functionality of the home. A house with outdated, inefficient, or visibly worn appliances may be seen as requiring immediate investment from the buyer, which can lead to lower offers or extended time on the market. Conversely, a home with modern, energy-efficient fixtures signals care, modernization, and reduced future expenses—all qualities that enhance perceived value.

Consider two otherwise identical homes on the market. One has original appliances from the 1990s—top-freezer refrigerators, a loud washing machine, and an old electric oven. The other has been updated with stainless steel, energy-efficient models. Buyers touring these homes will likely associate the first with deferred maintenance and potential repair costs, while viewing the second as move-in ready and modern. Even if the difference in actual value is only a few thousand dollars, the psychological impact can be much greater, influencing bidding behavior and negotiation leverage.

Furthermore, updated appliances contribute to faster sales. Homes that require fewer immediate upgrades appeal to a broader range of buyers, including those with limited budgets or renovation capacity. In tight markets, this advantage can mean selling within weeks rather than months, reducing carrying costs like mortgage payments, insurance, and property taxes. For homeowners planning to move in the near future, strategic appliance upgrades can serve as a high-impact, cost-effective way to boost marketability and maximize return on investment.

Risk Control: Avoiding Costly Breakdowns

One of the most overlooked aspects of appliance ownership is risk management. Aging appliances are not just inefficient—they are unpredictable. A water heater that’s 12 years old may fail without warning, leading to flooding, water damage, and costly repairs. A refrigerator with a failing compressor might shut down during a heatwave, spoiling hundreds of dollars’ worth of food. These events are not merely inconveniences; they represent real financial risks that can disrupt household budgets and cause stress.

From a financial perspective, upgrading aging appliances is a form of insurance. Just as homeowners pay premiums to protect against fire or theft, replacing appliances before failure protects against sudden, high-cost events. The cost of a planned replacement is predictable and controllable. It can be budgeted, researched, and timed for optimal pricing. In contrast, emergency replacements are reactive, rushed, and often more expensive due to expedited labor, delivery fees, and limited product availability.

Moreover, the secondary costs of appliance failure can far exceed the price of the unit itself. A burst water heater can damage floors, walls, and ceilings, leading to thousands in restoration costs. A malfunctioning HVAC system during extreme weather can force temporary relocation or create health risks. Food spoilage from a failed refrigerator adds both financial and logistical burdens. By upgrading before failure, homeowners eliminate or reduce these risks, gaining not only better performance but also financial protection.

This approach aligns with sound financial planning principles: identify potential liabilities, assess their likelihood and impact, and take proactive steps to mitigate them. Appliance upgrades fit neatly into this framework. They are relatively low-cost compared to the potential damages they prevent, and their benefits are both immediate and long-term. When framed as risk-control measures, upgrades become not optional luxuries but essential components of household financial resilience.

Building a Sustainable Upgrade Plan

The most effective way to maximize the financial benefits of appliance upgrades is to adopt a structured, long-term plan. Instead of reacting to breakdowns or making decisions based on sales alone, households should develop a personalized appliance lifecycle strategy. This plan tracks the age, condition, and efficiency of each major unit, sets replacement timelines, and allocates budget accordingly.

Start by creating a simple inventory: list each major appliance, its purchase date, brand, model, and expected lifespan. Update this list annually. Use it to identify units approaching the end of their service life. Next, prioritize upgrades based on impact. Focus first on appliances with the highest energy consumption—refrigerators, HVAC systems, and water heaters—as these offer the greatest savings potential. Then consider units that pose the highest risk if they fail, such as water heaters and washing machines, which can cause water damage.

Budgeting is a critical part of the plan. Rather than saving for one large purchase, spread the cost over time. For example, if a $1,000 refrigerator is expected to be replaced in five years, set aside $17 per month. This approach smooths cash flow and prevents financial strain. It also allows for flexibility—funds can be redirected if an appliance lasts longer than expected, or accelerated if an early replacement becomes necessary.

Finally, integrate incentives and timing into the plan. Schedule upgrades to coincide with known rebate periods, tax credit availability, or seasonal sales. Stay informed about technological improvements—new efficiency standards or smart features may make waiting a year worthwhile. The goal is to move from emotional or crisis-driven decisions to a disciplined, forward-looking strategy that aligns with overall financial health.

By treating appliance upgrades as cyclical investments rather than one-off expenses, families gain control over household spending, reduce long-term costs, and build resilience against unexpected events. This shift in mindset—from consumer to investor—transforms routine maintenance into a powerful tool for financial empowerment.

Appliance upgrades aren’t just about comfort or aesthetics—they’re a quiet but powerful part of personal finance. When approached with strategy, they generate returns through savings, risk reduction, and increased home value. By seeing these purchases as cyclical investments rather than one-off costs, you gain control over household spending and build lasting financial resilience. It’s not about buying more—it’s about investing wisely in what powers your daily life.